2023.01.21 Weekly Note

Bearish narratives now lacking

Bearish narratives now lacking

AI capex and fiscal tailwinds keeps the growth outlook hot. Soft payrolls, but firmer wages, strong ISM services, even Challenger had some positive points for once. Equities broaden, SMids lead, but short-vol look stretched.

Jam-packed macro slate ahead: labour market cooling not cracking, equities breadth shaky but probably just consolidation and done, watching DJFXCM Dollar, watching BTC/XAG

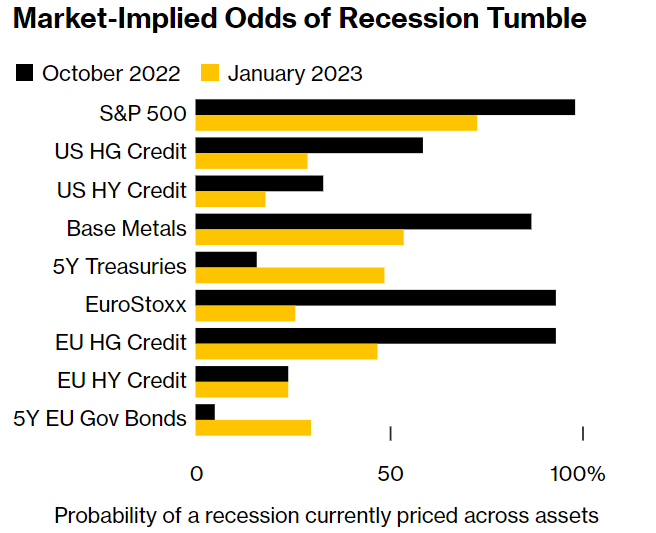

Strong gdp prices and growth data challenges “inflation beaten.” Risk-on equities has room to broaden with volatility falling. Fading dominant narratives in commodities, favoring cross-JPY longs, selectively USD longs, and constructive on BTC.

![Week52 MacroTechnicals - Santa Claus is coming to [low-vol] town](/content/images/size/w600/2025/12/ARTICLE-Macrotechnicals-FINAL-01-2.png)

Low post-OPEX vol supports odds of a late Santa-rally, bullish SPX above 6840. Metals are stretched with a few reasons for risk of a pullback. Ueda could jolt JPY.