Week43 MacroTechnicals - Flippage

Flippage - Was bearish risk this time last week, but a TACO headline and Trump confirming the meeting with Xi would go ahead to result in trade tensions simmering down till the end of the month, as well as how the charts have evolved over the last week has shifted my view on risk.

Flippage

Was bearish risk this time last week, but a TACO headline and Trump confirming the meeting with Xi would go ahead to result in trade tensions simmering down till the end of the month, as well as how the charts have evolved over the last week has shifted my view on risk.

Here's what's changed...

TACO?

A major component of my bearish view stems from China’s expansion of REE export controls followed by Trump’s imposition of 100% tariffs, a sequence of rapid escalations that resulted in a stand-off between the two sides. The US demanded China reverse its recent actions before considering the removal of the additional 100% tariff, whereas China firmly maintained that its actions were fully justified. At the time, it was hard for me to see a scenario where either side would make the first move to reverse their latest action to deescalate. But then came Trump's interview on Fox Business...

Trump was asked whether the 100% tariffs could stand, to which he replied, 'No,' which initially seemed like a true TACO moment based on the headline. Having watched the interview however, it looks to have been taken out of context:

But even so, I'm not so sure that changes the general belief that something will be worked out after Trump confirmed a meeting with Xi in Korea is on. How much progress is to come out of that meeting remains to be seen given a long list of issues to work through, but if there is to be any progress, I think Trump and the US side will have to show a bit more good faith towards China than they have recently (e.g. US representatives claiming that China showed signs of realising that have 'misstepped' on their part, when in fact comments from China suggested absolutely nothing of that nature). So while the headlines may not have been a true TACO moment as it first appeared, the meeting going ahead implies some likely deescalation and progress than not, and that seems to be the general sentiment of the market for the moment. It would in my view be perfectly reasonable to assume that trade tensions will continue to simmer down until the meeting on October 30th/31st.

Systematic selling?

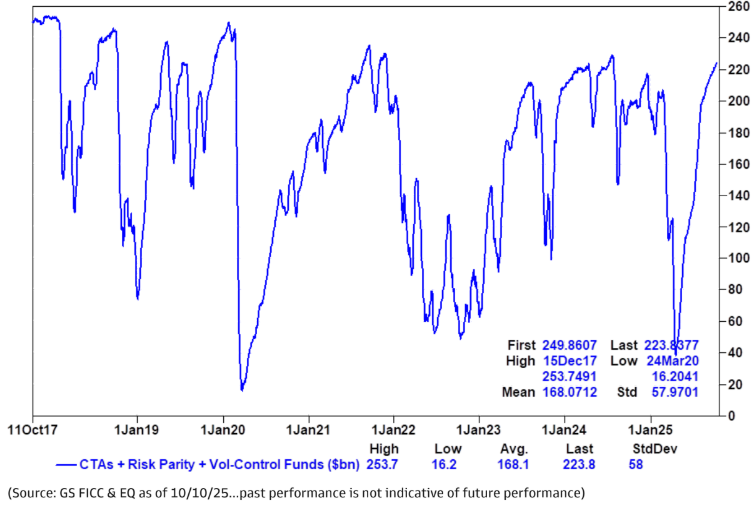

One key consideration that weighed in on my views last week was the extreme positioning among systematics that would present relatively strong potential for CTA's to introduce some mechanical selling as the trend turns. The chart below is over a week old but is a good depiction of why I thought there was strong enough implied odds for a deep correction in equities. But after what first appeared like a TACO moment and the massive vol-crush on Friday's OPEX, I now no-longer see a meaningful turn in trend that would lead to anything remotely close to a meaningful unwind in systematic positioning.

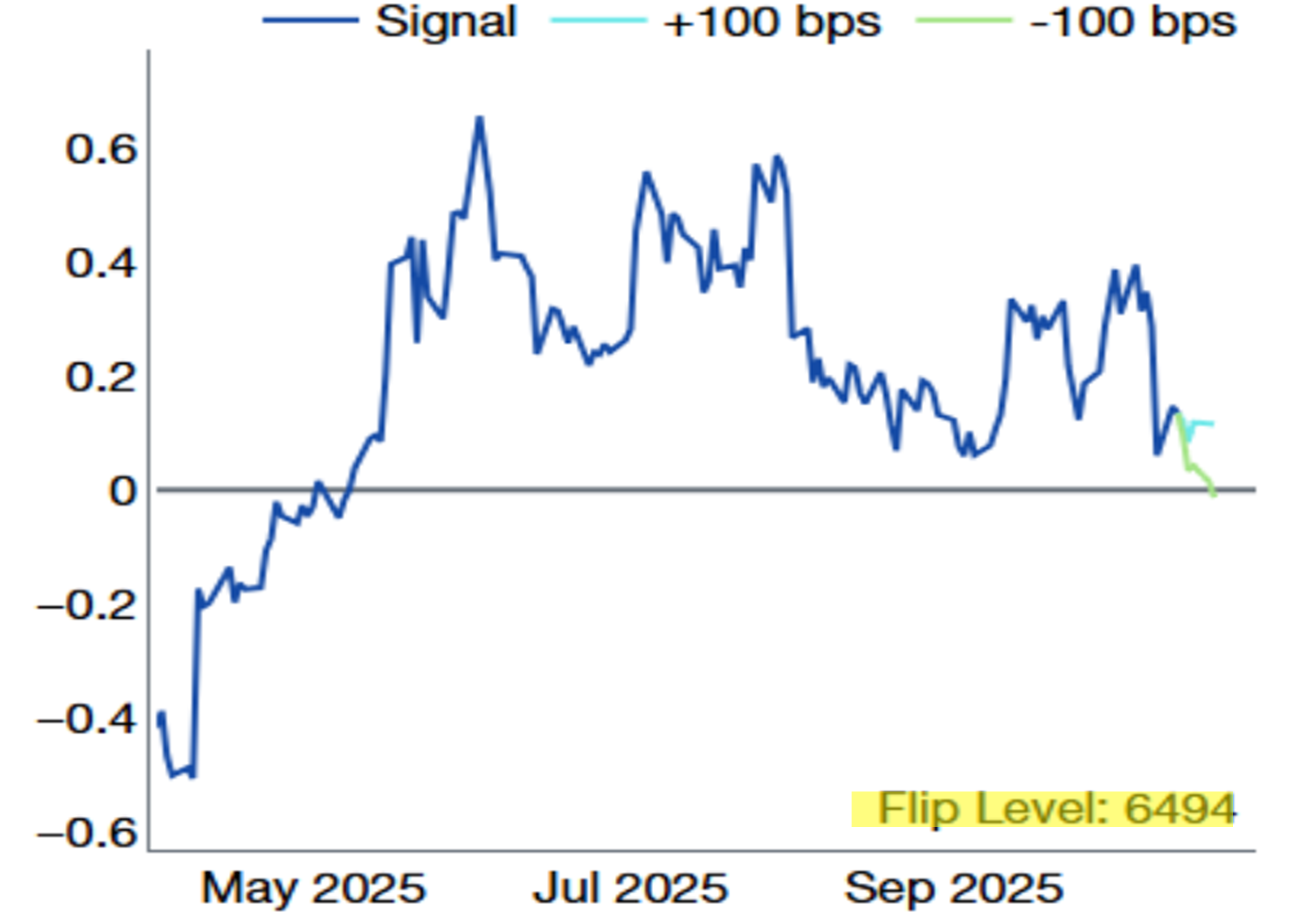

Scott Rubner noted last week that SPX would have had to sink below 6500 for CTAs to 'flip' bearish, but a strong finish last Friday has left the SPX almost 200pts clear of those levels, and the VIX a touch lower on the week.

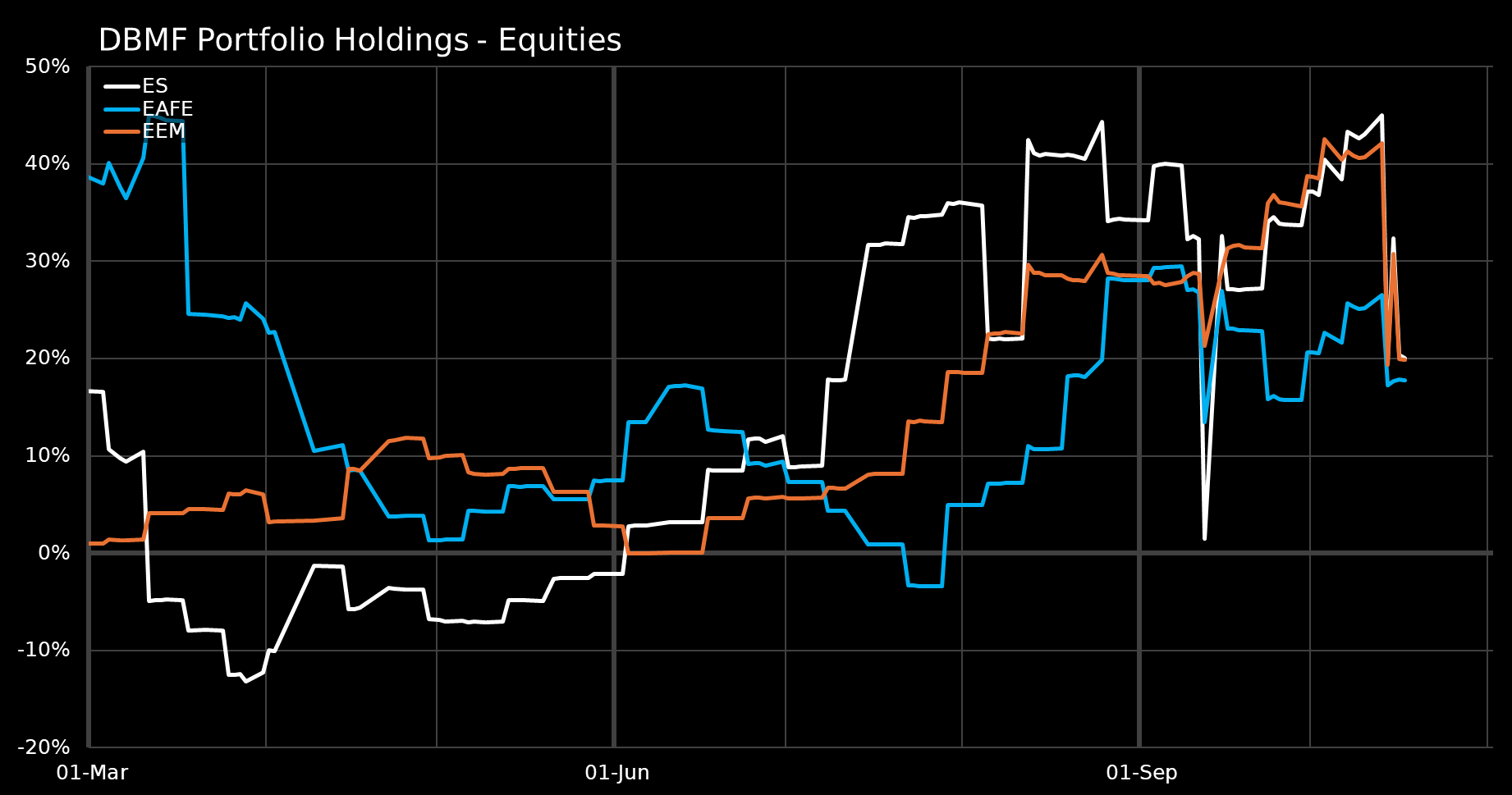

Also, CTAs have been reducing their equities exposure according to sell-side notes with proxies such as the chart below corroborating those reports. With SPX stopping short of flip levels and CTA's having deleveraged to some degree, positioning risks would now appear materially weaker than it was recently.

Vol-control funds were also another systematic strategy that has seen extreme positioning, but with 30-day realised volatility peaking last Monday and stalling out at 11% the rest of last week, it's not quite clear to me that we will see significant deleveraging from VC funds materialise, particularly as a sense of calm appears to be returning after the VIX reached 28.99 on Friday to then close the session at 20.77. Scott Rubner notes that these fund are typically slow to react, and so long as realised vol does not continue its sharp move higher, I think the case for meaningful deleveraging from VC funds would start to turn weaker from here.

Risk-On Till Month-End

Putting it together, it appears that markets can put off worries about any further trade escalations for another 2 weeks and look forward to a period of calm, easing vol, and to perhaps go back to riding the bubbling AI-capex frenzy.

MACRO

Unemployment

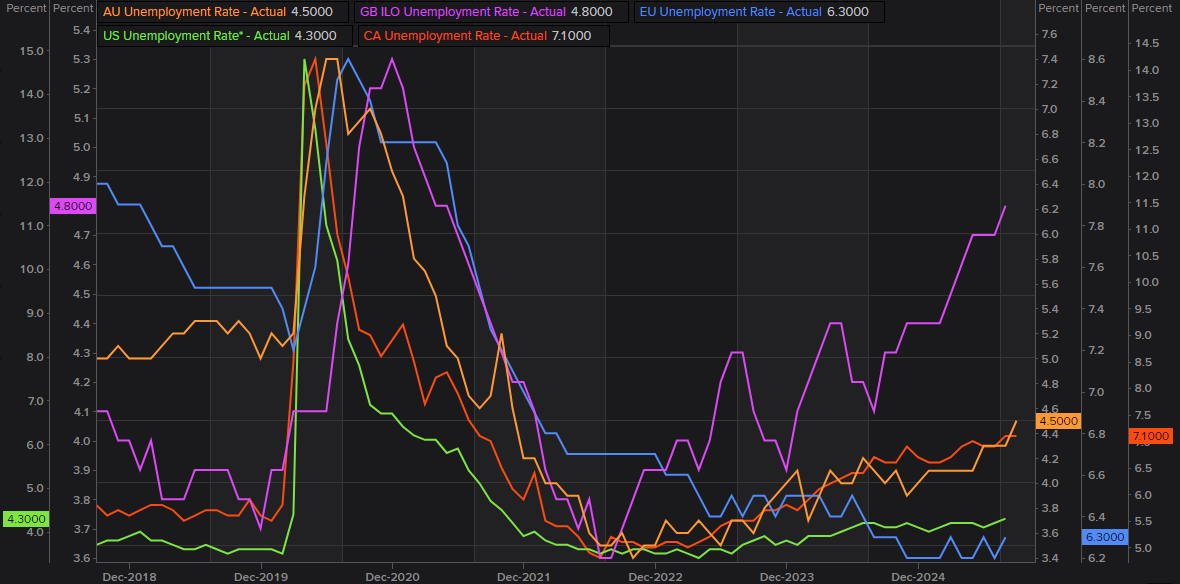

As major central banks are shifting focus towards the labour market with inflation 'largely assumed' to have been tamed while recognising upside risks from tariffs, latest data from Australia and the UK will have added to concerns around a weakening labour market - UK unemployment rate reached the highest level in 4.5 years (May'21) at 4.8%, and the highest in almost 4 years (Nov'21) for Australia at 4.5%. Canada the week before reached the highest in over 4 years (Aug'21) though the latest payrolls report did stave off expectations for further weakening.

Comparing those to the US and Europe, the pick-up in UE remains very gradual for the US while the European trend has been flat the last 12-months or so.

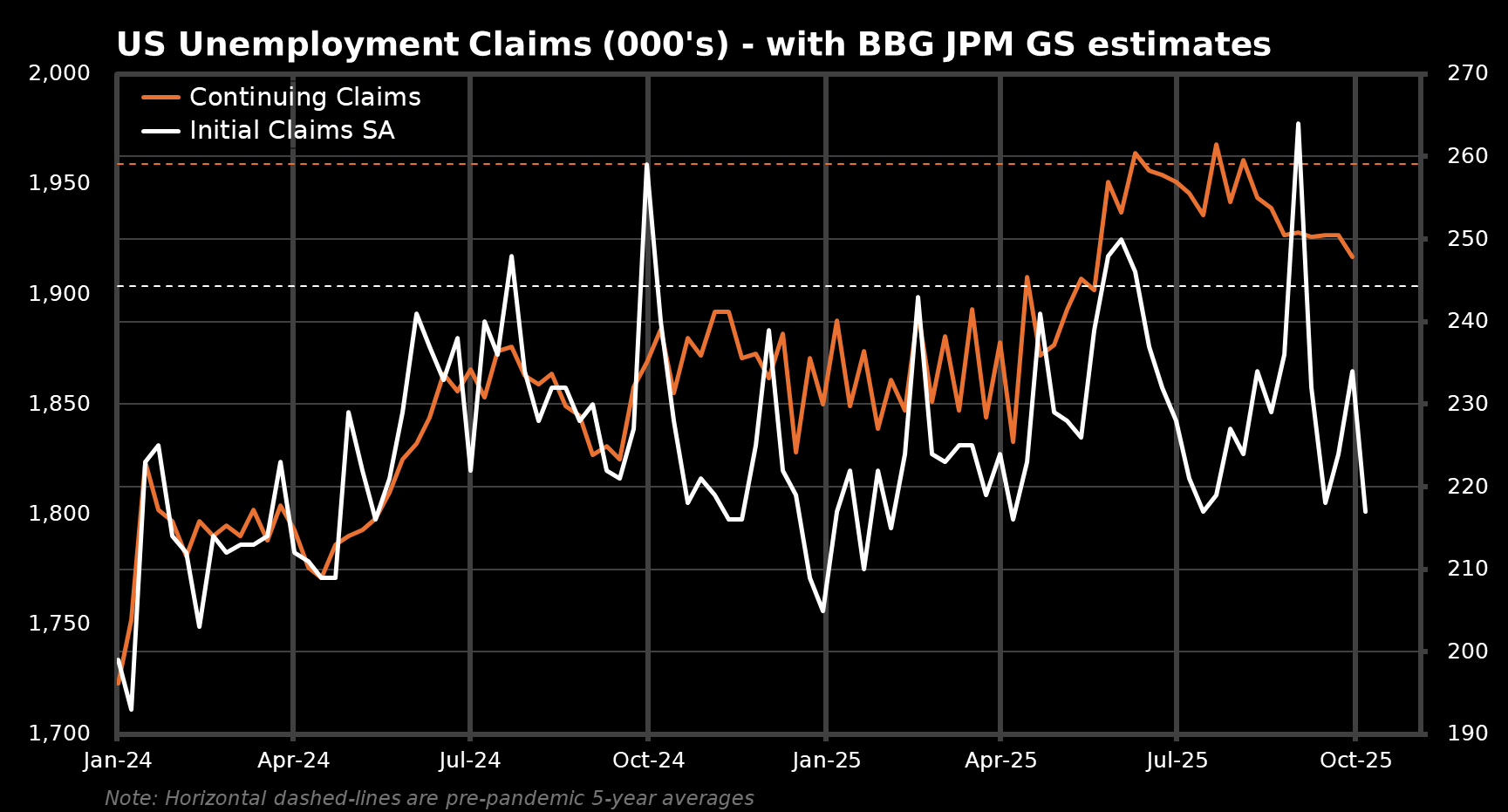

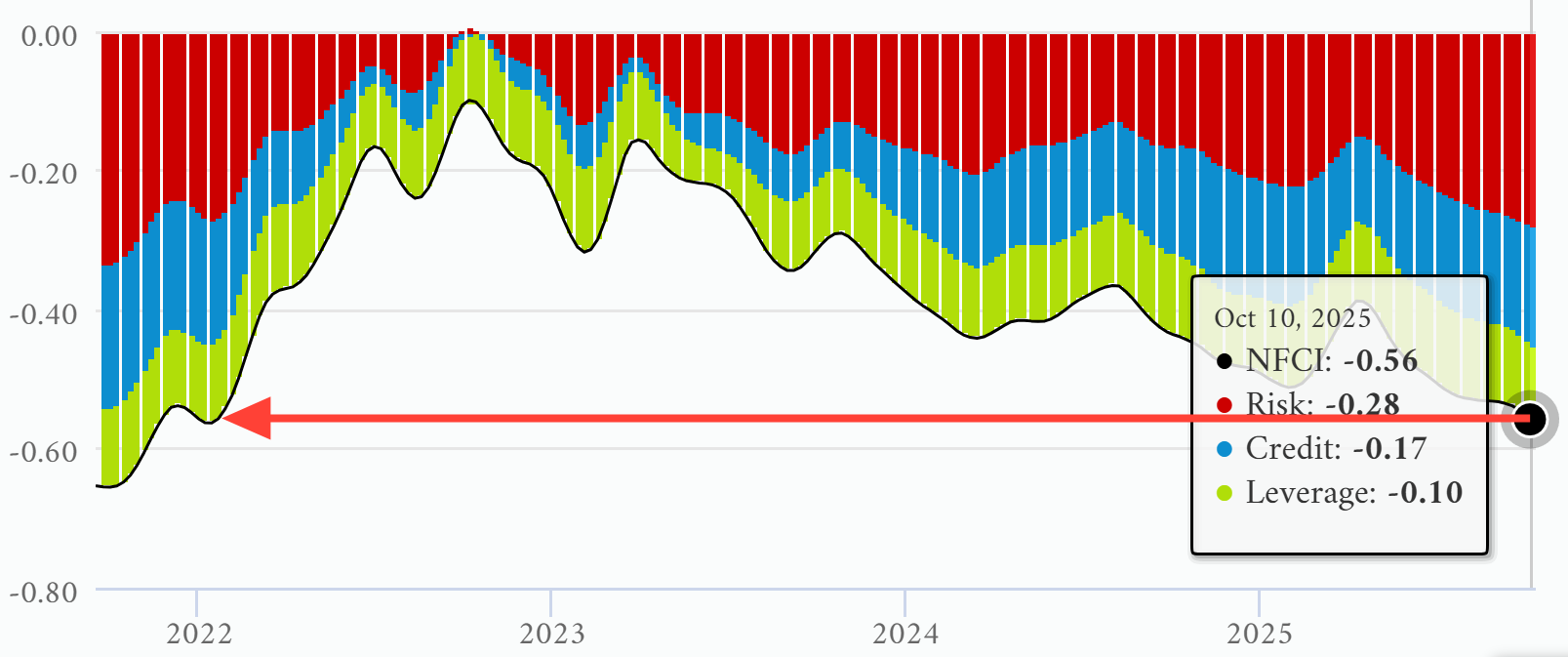

Using estimates from Bloomberg Economics, JP Morgan and Goldman Sachs to fill in the blanks amid a US government shutdown, both US initial and continuing claims have retreated, suggesting layoffs remain low and unemployment levels have come down, and that the Fed is, perhaps, overly concerned about the labour market while asset price returns are extraordinarily strong and financial conditions perceivably loose.

The Fed's Beige Book notes:

- Employment levels have been mostly steady, but many employers are reducing headcounts through layoffs and attrition due to weaker demand and economic uncertainty.

- Labor demand is muted overall, with some districts and sectors favoring temporary or part-time hires over full-time roles.

- Labor supply constraints persist in hospitality, agriculture, construction, and manufacturing, driven by recent immigration policy changes.

- Wages are rising moderately across districts, with labor cost pressures increasing due to significant employer health insurance cost hikes.

- Employers are cautious, pausing expansion and new hiring while maintaining existing workforces, reflecting a cooling labor market rather than sharp contraction.

US Consumer

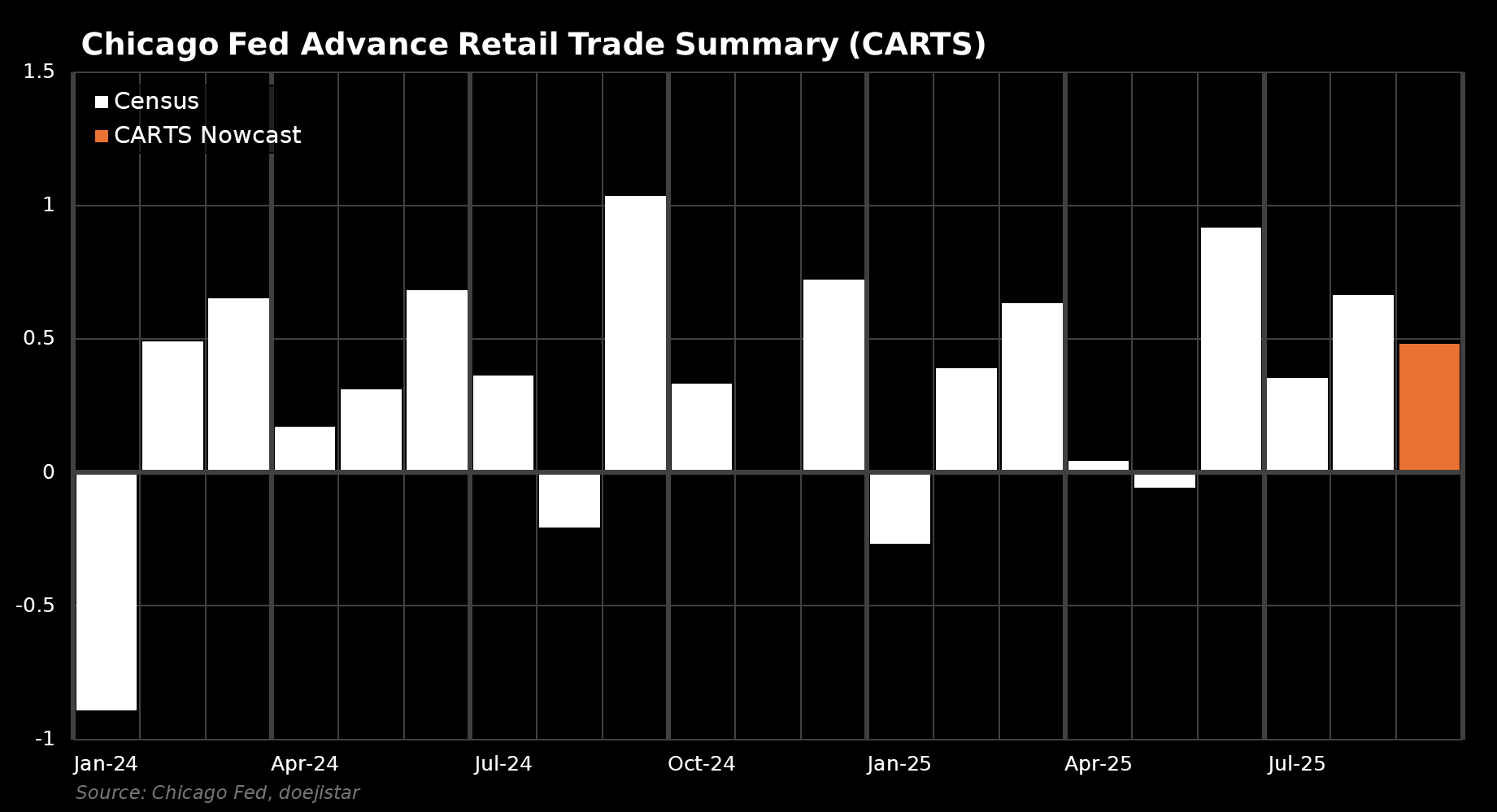

Chicago Fed's Retail Sales estimate points to continually robust strong consumer spending. Recent company reports have begun to show shifting behaviour with demand becoming increasingly segmented - higher-incomes continue to splurge on premium goods and experiences, while spending behaviour among middle and lower-incomes have shifted toward value-conscious spending.

Here's what we have learned so far from the most recent company reports:

- American Express: strong premium card customer growth; rising fees and new account acquisitions; confidence in sustained spending

- Delta Airlines: robust demand for premium travel

- Levi Strauss: signature brand saw double-digit growth in value-driven purchases

- McCormick & Co: resilience with stronger-than-expected Q3 results despite commodity cost pressures.

- Domino's Pizza: consumers prioritizing value when dining out or ordering-in and moving to smaller pack sizes for snacks

- Pepsi Co: stable and improving US sales supported by pricing power, smaller pack sizes for affordability

The Fed's Beige Book also observes similar patterns:

- Overall retail spending inched down slightly, though auto sales were boosted by electric vehicle demand ahead of a tax credit expiration at September-end.

- Leisure and hospitality services saw weakening demand from international travelers, while domestic demand remained stable.

- Spending on luxury travel and accommodations stayed strong among higher-income individuals. Lower- and middle-income households increasingly sought discounts and promotions due to rising prices and uncertain economic outlooks.

US Growth

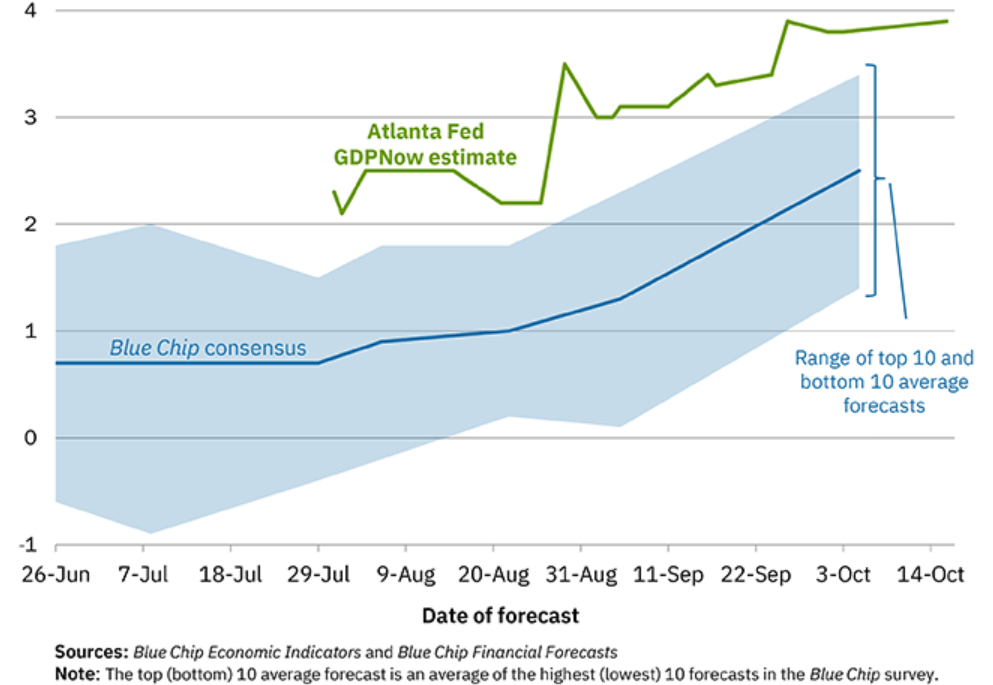

Strong. Atlanta Fed's GDP nowcast for Q3 as of October 17, 2025 puts annualised GDP at 3.9%. The Fed's Beige Book notes the following on Economic Activity:

- Consumer spending and manufacturing sales edged up modestly.

- Commercial real estate activity slightly exceeded expectations, while home sales were flat with rising inventories.

- Business outlooks have brightened to mostly neutral or cautiously optimistic, though non-business contacts express growing concerns about economic security for lower-income households.

Latest from Powell

Key points from his Speech last Tuesday:

"Based on the data that we do have, it is fair to say that the outlook for employment and inflation does not appear to have changed much since our September meeting four weeks ago"

"available evidence suggests that both layoffs and hiring remain low, and that both households' perceptions of job availability and firms' perceptions of hiring difficulty continue their downward trajectories. You do have a bit of tension between labor market data - we see very low levels of job creation - and yet people are spending. We are going to have to see how that plays out."

"Data available prior to the shutdown, however, show that growth in economic activity may be on a somewhat firmer trajectory than expected."

Fed's Beige Book on Prices:

- Input costs rose faster due to higher import prices and increased expenses for services such as insurance, health care, and technology.

- Tariff-driven cost increases were widespread, but firms varied in passing these costs to customers. Some maintained prices to protect market share amid pushback from price-sensitive clients.

- Manufacturing and retail sectors more fully passed import cost hikes onto customers.

The Uncertainty Premium

To slide in my own view on the Fed giving more weight to the labour market over inflation risks, in my mind I think the risk that the Fed could be wrong in trading-off price stability for maximum employment risks is becoming increasingly high.

For instance, if the 'uncertainties' around Trump's policies begin to fade - as we saw with Trump's latest TACO move, and labour market activity picks up as a result - which we've seen plenty of evidence to know that Trump's policy-related uncertainties is the reason for low labour market churn, then the very thing the Fed have cited as cause for cuts would no longer hold up with economic growth proving strong, as is consumer spending despite some shifts in behaviour - also uncertainty related. Meanwhile, inflation trend is heading in the wrong direction and likely to stay elevated as the tariff impact on tighter supply chains isn't likely to dissipate overnight.

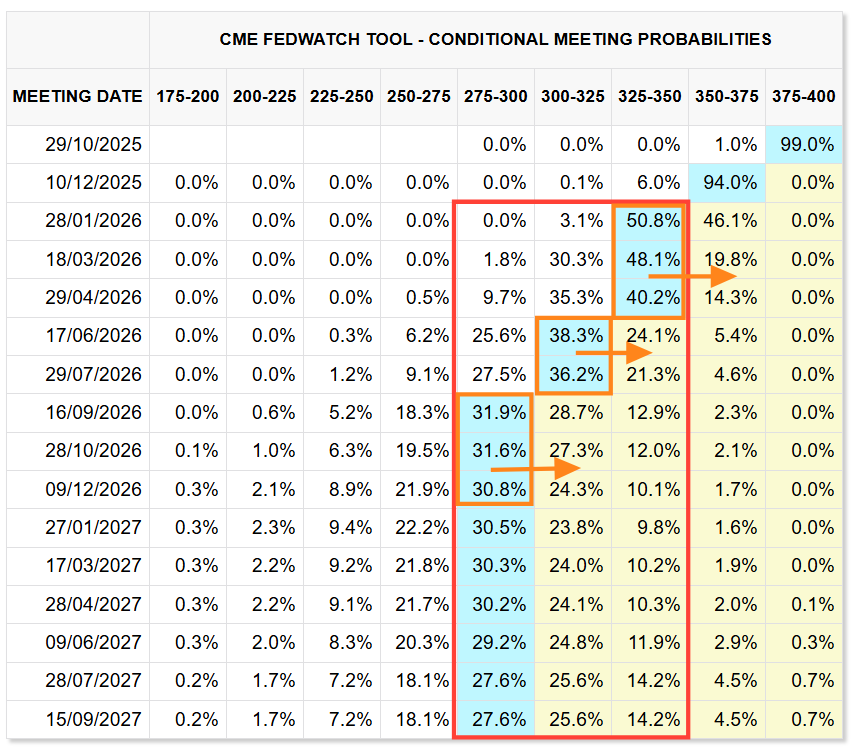

The market expects the Fed to go on with 2 more continuous cuts this year which would be inline with the Fed's last SEP median rate at 3.6% by the end of the year.

But should uncertainties recede going forward and both supply and demand-side confidence in the labour market returns, while taking into account that the consumer economy points to resilience, the 2026 spread (currently pricing in 80bps of cuts for 2026 via the monthly fed fund futures) would appear, at least, 15-20bps too rich and vulnerable to a repricing from 3 cuts to 2 cuts next year.

Also, as dovish as the Fed might sound recently, even they don't currently see as much easing as the market is expecting next year. Putting that 80bps of cuts priced -in into perspective against the 2026 of 3.4% by the end of 2026, that is much higher than the 2.75-3.00% range currently priced by the market.

The market has been buoyed by the Fed's willingness to insure the US economy against a labour market slowdown - the degree of which is rigorously questionable, and even in the face of progressively easier financial conditions that has helped to support a rather bubblicious stock market.

I don't think there is any doubt about how accommodative the Fed is being at the moment with inflation risks heading in the wrong direction, and the market certainly is not complaining. I would argue however that the Fed may be misinterpreting economic signals due to the high level of policy related uncertainty, such that if uncertainties were to fade on top of what has been an otherwise robust economy, so could the case for aggressive easing by the Fed into next year leaving the market very mispriced for such a scenario. Will the extreme uncertainty around Trump's policies persist for the next 6 to 12 months? Possibly, but I very much doubt it.

![Week52 MacroTechnicals - Santa Claus is coming to [low-vol] town](/content/images/size/w600/2025/12/ARTICLE-Macrotechnicals-FINAL-01-2.png)