Week45 MacroTechnicals - Tailwinds become Headwinds

Big news. Conventional wisdom would say this is massively risk-on - 1) a swift reversal in all retaliatory measures may have come as a slight surprise, and 2) the 1-year truce will now lift a huge veil of uncertainty that has weighed on economic activity for the majority of 2025. I consider that latter point central to my macro views for the coming months, and views of which I think will be highly nuanced from time to time. As I like to say, risk-off and risk-on comes in a variety of flavours, and I think that will be particularly true over the coming months versus what we've experienced the past 4-months or so.

Macro

US-China Deal Signals Massive De-escalation

A lot of progress appears to have been between Trump and XI and their respective teams during their Asia visit that resulted in what appears to effectively reverse all US-China escalations since April 1st (for 1-year).

Chinese Actions:

- remove/suspend all export controls (imposed in April 2025, October 2022 and announced in October 2025) and replaced issuance of export licenses for the export of rare earths and other critical elements.

- suspend all retaliatory tariffs announced since March 2025 , countermeasures and sanctions including termination of investigations against US semiconductor manufacturing and other major US companies, and retaliation against US section 301 investigation related to Maritime, Logistics, and Shipbuilding, to remove sanctions imposed on various shipping entities.

- ensure resumption of trade from Nexperia’s facilities in China, allowing production of critical legacy chips to flow to the rest of the world.

- stop the flow of Fentanyl and certain designated chemicals to North America and strictly control global exports of certain other chemicals.

- purchase US Agricultural products for the next 3-years.

- extend US import tariff exclusion until end of 2026.

American Actions:

- suspend heightened reciprocal tariffs on Chinese imports until November 10, 2026. (current 10% reciprocal tariff will remain in effect during this suspension period)

- extend expiration of certain Section 301 tariff exclusions until November 10, 2026.

- suspend implementation of Expansion of End-User Controls to Cover Affiliates of Certain Listed Entities until November 10, 2026

- suspend implementation of responsive actions taken pursuant to Section 301. US will negotiate with China while continuing its historic cooperation with the Republic of Korea and Japan on revitalizing American shipbuilding.

Other Deals During The Asia Trip:

- Reciprocal trade agreements with Malaysia & Cambodia - standards acceptance, restrictions on health policies, export restrictions, sovereignty concerns, and US influence on international positions.

- Japan: Major projects, critical minerals agreement, energy purchases, enhanced cooperation on drug trafficking, reaffirming the $550 billion investment to the US.

- Korea: Landmark commitments, investments, energy support, technology leadership, maritime partnership.

Where Does That Leave Us?

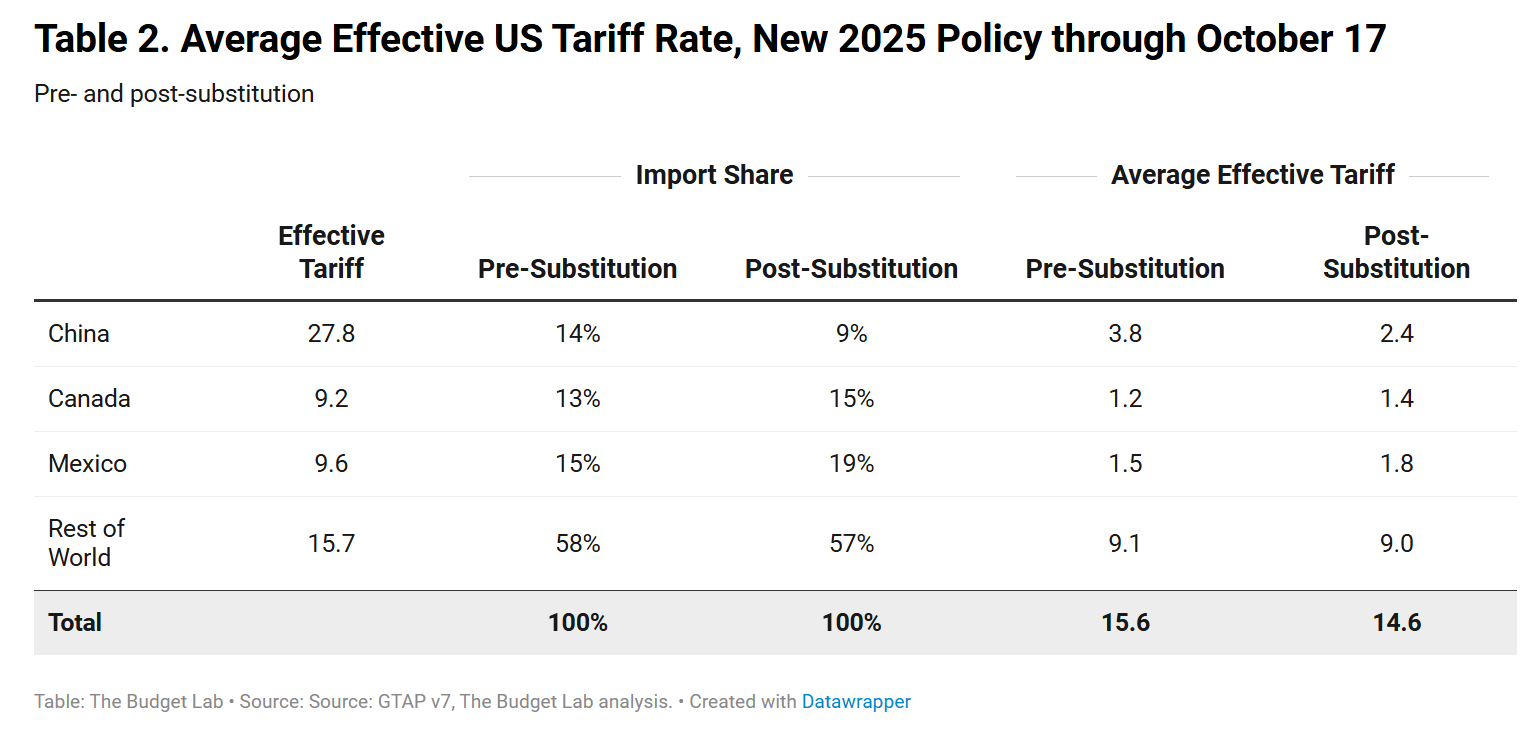

At 30%. According to the terms of the 1-year truce, only just "10% reciprocal tariff will remain in effect during this suspension period" of the total +125% tariffs imposed since April 2nd, so just the 20% and the 10% baseline remains (in bold):

- Initial "fentanyl" tariff was at 20% before April 2025.

- Liberation day tariffs added another +10% universal/baseline tariff, and then another +24% reciprocal tariff.

- Then a +91% countermeasure against China's REE export controls.

In terms of the effective tariff rate, the discussion gets convoluted depending on various assumptions taken on the many overlaps and exemptions under Section 232 and Section 301 Tariffs, and there is also the matter of a 17.5% import tax charged on goods from China. I'll leave that discussion for the experts but most estimates I've seen have been in the 25-35% range.

If we start by considering what market expectations in March had been - that Trump was expected to impose a 10-15% universal tariff on April-2nd, we're essentially back to where started. Not much has appeared to changed with respect to tariff rates, but a great deal else has over that 6-month trade-war and will take time to normalise.

Fed On Hodl?

Policy Statement

- judged appropriate to take another step toward neutral

- December cut is not a forgone conclusion—"far from it"

- QT to conclude on December 1st

- labor market gradually cooling, inflation somewhat elevated - available public and private-sector data suggest the outlook has not changed since September meeting.

- tariffs pushing up prices in some goods resulting in higher inflation and short-term inflation expectations, but assumed to be a one-time shift in price levels. "Our obligation is to ensure that a one-time increase in the price level does not become an ongoing inflation problem".

Presser Takeaways

Powell hints that the risk management exercise could be done in response to Timiraos's "at what point do you conclude that you've taken out enough insurance?" question, and that there's a "growing chorus" to "at least wait a cycle":

If the two goals are sort of equally at risk, then you ought to be at neutral, because one of them is calling for you to hike, and one of them is calling for you to cut. So if that got back into balance, then you'd want to be roughly at neutral. So in that sense it was risk management, and I would say the same about today. Sort of the same logic. But as I mentioned, going forward is a different thing.

we're at a place now where we have, in fact, cut two more times, and now we're 150 basis points closer to neutral, wherever that may be, than we were a year ago. And so there's a growing chorus now of feeling like maybe this is where we should at least wait a cycle, something like that.

Appropriate to support the labour demand, though the labour market is seen to be stable and not weakening:

So, I and many of my colleagues thought that it was appropriate for us to react by supporting demand with our rates. And we've done that, we've reduced so that rates are looser, I wouldn't say that they're accommodative right now, but they're meaningfully less tight than they were. And that should help so that at least the labor market doesn't get worse. So it's a complicated situation and some people argue that this is supply and we really can't affect it much with our tools, but others argue, as I do, that there is an effect from demand, and that we should use our tools to support the labor market when we see this happening.

it's not about 25 basis points here or there. We use our tools to support the labor market and to create price stability. That's what we do. That's our two jobs, right? So, we're here to – by lowering rates at the margin that will support demand, and that will support more hiring. And that's why we do it. Now, no 25 basis point, or even 50 basis point hike is going to be a dispositive thing, but ultimately lower rates will support more demand, and that'll support hiring over time, and of course we also have to be careful about this

we do not see the weakness in the job market accelerating. There's just no story over the last four weeks. It's kind of stable. you don't see it in the aggregate numbers, the layoff numbers have not gone up. But job creation is very low. And the job finding rate for people who are unemployed is very low. But the unemployment rate is very low as well

Labour Market Demand Is Key

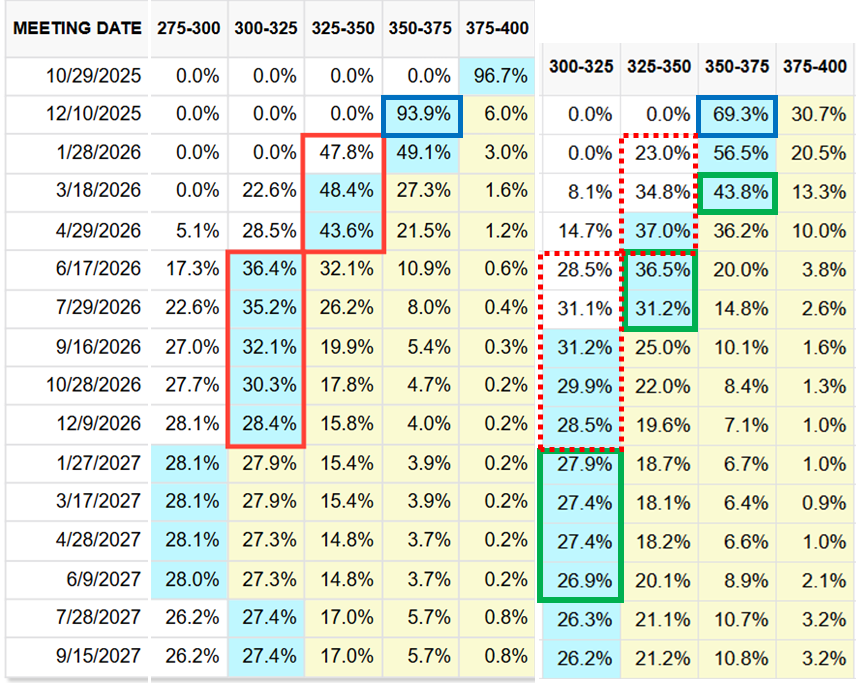

The emphasis on the last 2 policy decisions was a risk management cut to guard against low labour market demand, to which Powell suggests that the case for cuts "going forward is a different thing". I would take that to mean that they are now where they currently want to be, and want to be on hold for the rest of the year to assess labour market demand. Market appears to be in agreement repricing to a much slower pace of cuts (Green) while December odds have been shaved down from 94% to 69% (Blue):

I mentioned that I expected to see a shift to the right in those odds and it looks as though the aggressively dovish trend has hit the extremes and now reversing.

Consumer Confidence

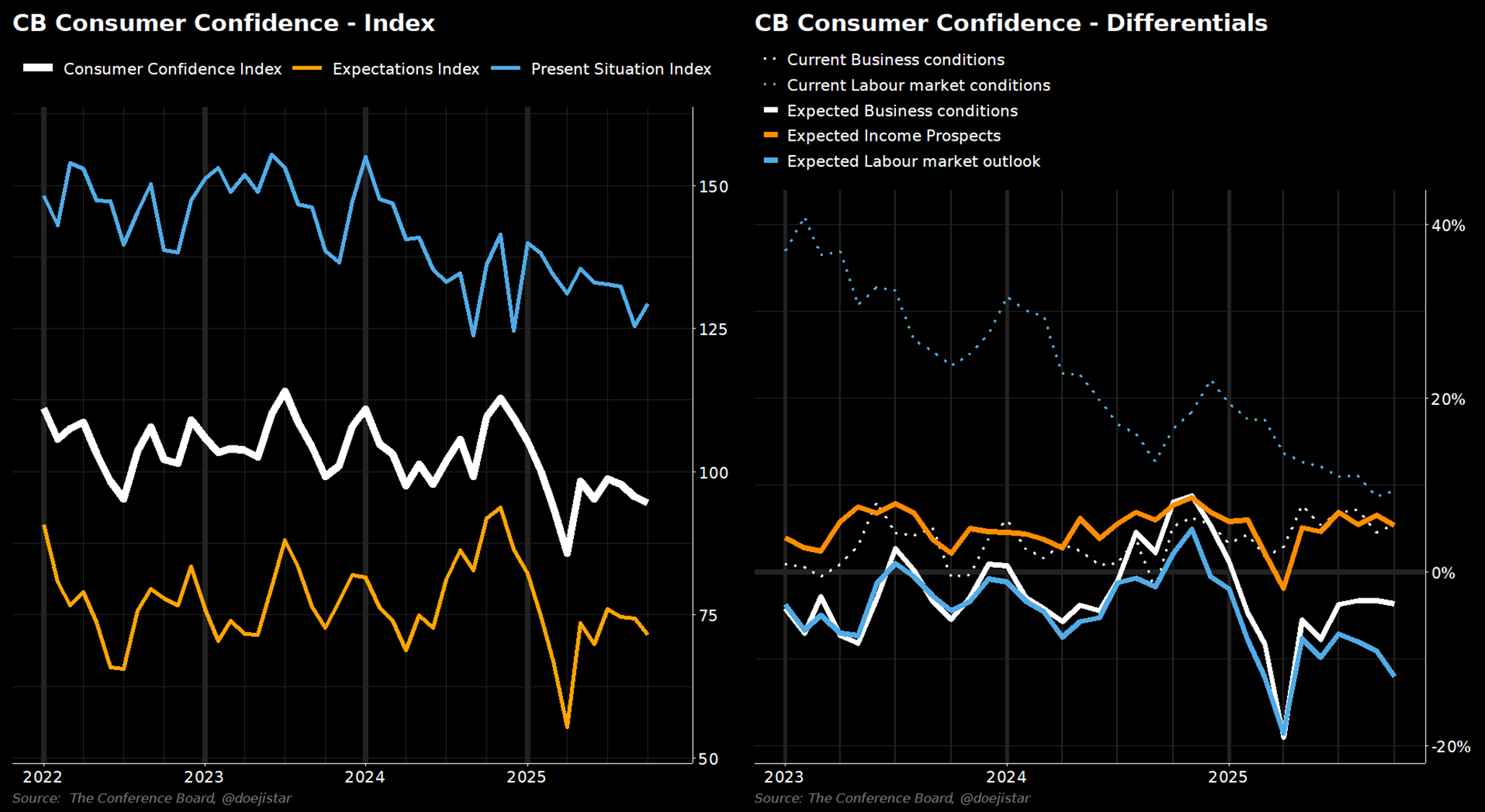

Consumer confidence fell slightly to 94.6 but wasn't as weak as the 93.4 expected while the prior month was revised up to 95.6 from 94.2. The Expectations index continued its decline driven by while there was an improvement on current conditions.

The Expectations index continued its decline driven by weakening consumer outlook on the labour market 6-months out. While all the expectation differentials had a negative delta in October, the 3 current conditions differentials were positive.

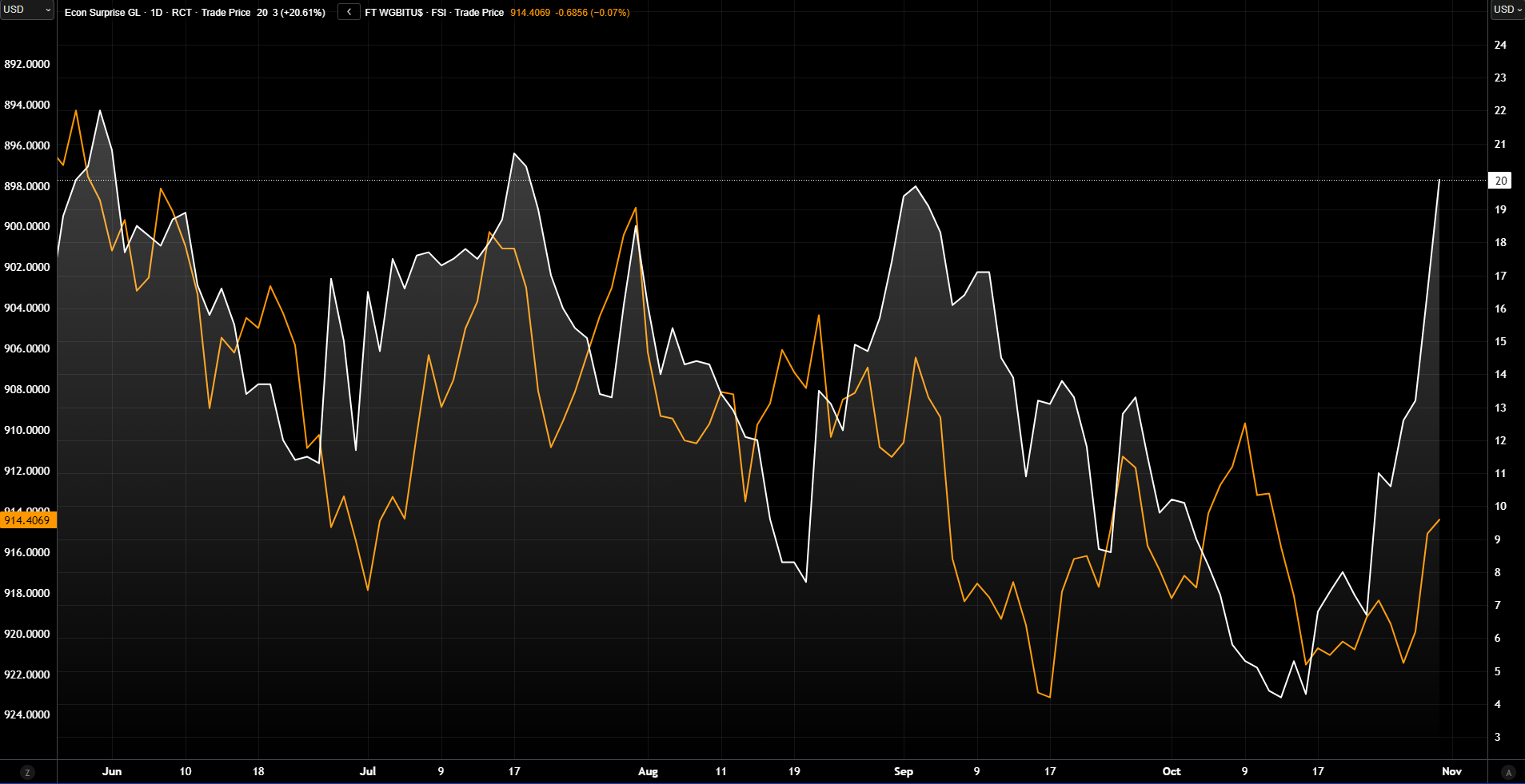

Global Data Trends

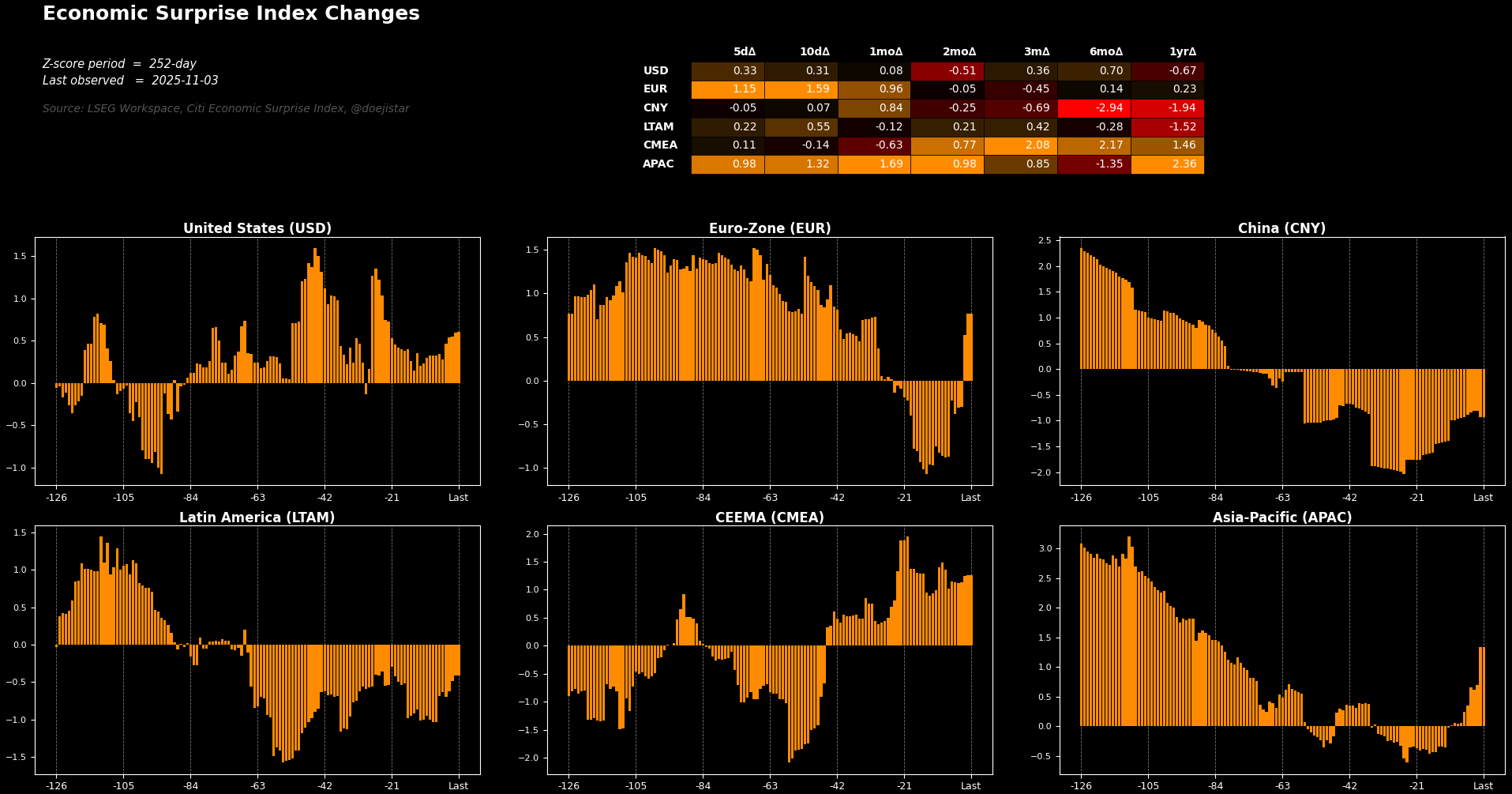

Data surprise indices have moved positively in recent weeks for the major economic regions, most notably for the Eurozone and APAC.

Global data surprises (White) rebounding sharply last month, suggesting that bond yields should follow that higher (Government bond price index, Orange). We'll return to this later in the 'Technicals - Rates & FX' section but if there is one strong message here - you really don't want to be thematically short on global growth given the emerging trend and latest developments around global trade.

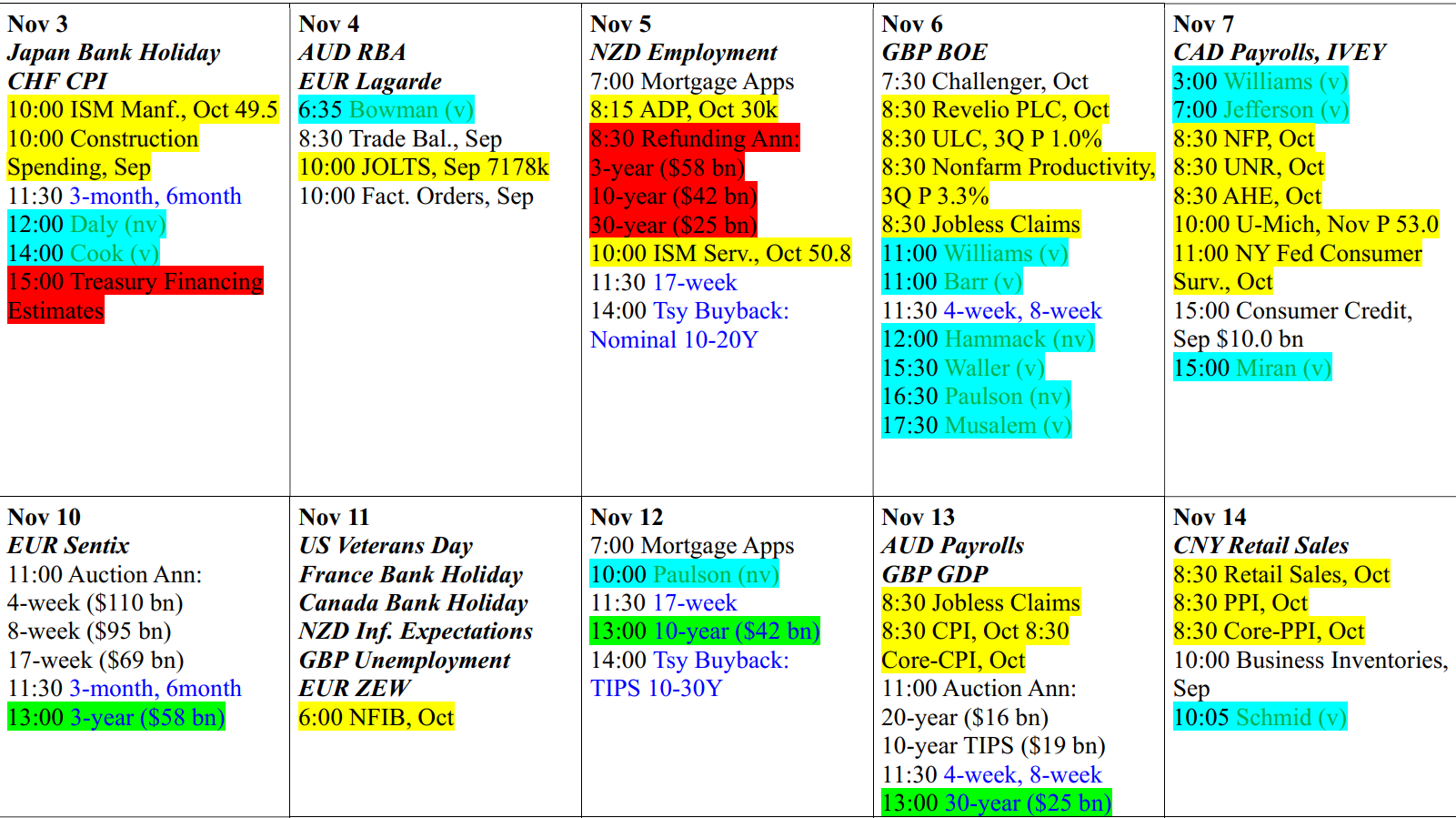

Calendar

ISM employment components, ADP, Revelio (substitute for NFP), and Treasury Refunding will be of main focus for the US. Plenty of Fedspeak on deck as the market attempts to gauge whether the Fed is on hold for the next few meetings. Elsewhere we have RBA and BoE (as well as Norway Mexico Brazil) rate decisions, and Employment data from New Zealand and Canada this week.

![Week52 MacroTechnicals - Santa Claus is coming to [low-vol] town](/content/images/size/w600/2025/12/ARTICLE-Macrotechnicals-FINAL-01-2.png)