Week46 MacroTechnicals - Buy Everything

Buy everything! But beware of higher rates too.

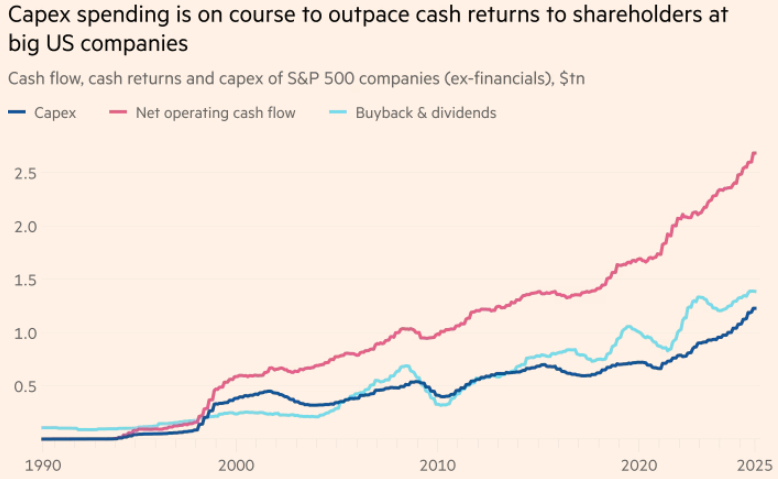

After a China-deal and Fed coming off a strong easing bias, the Government Shutdown ending would be a breath of fresh air for markets that was left to focus on negatives - a continuing shutdown, widespread ROI doubts around the massive AI-capex, as well as Sam Altman's asinine comments that OpenAI deserves a federal backstop if not extended government support.

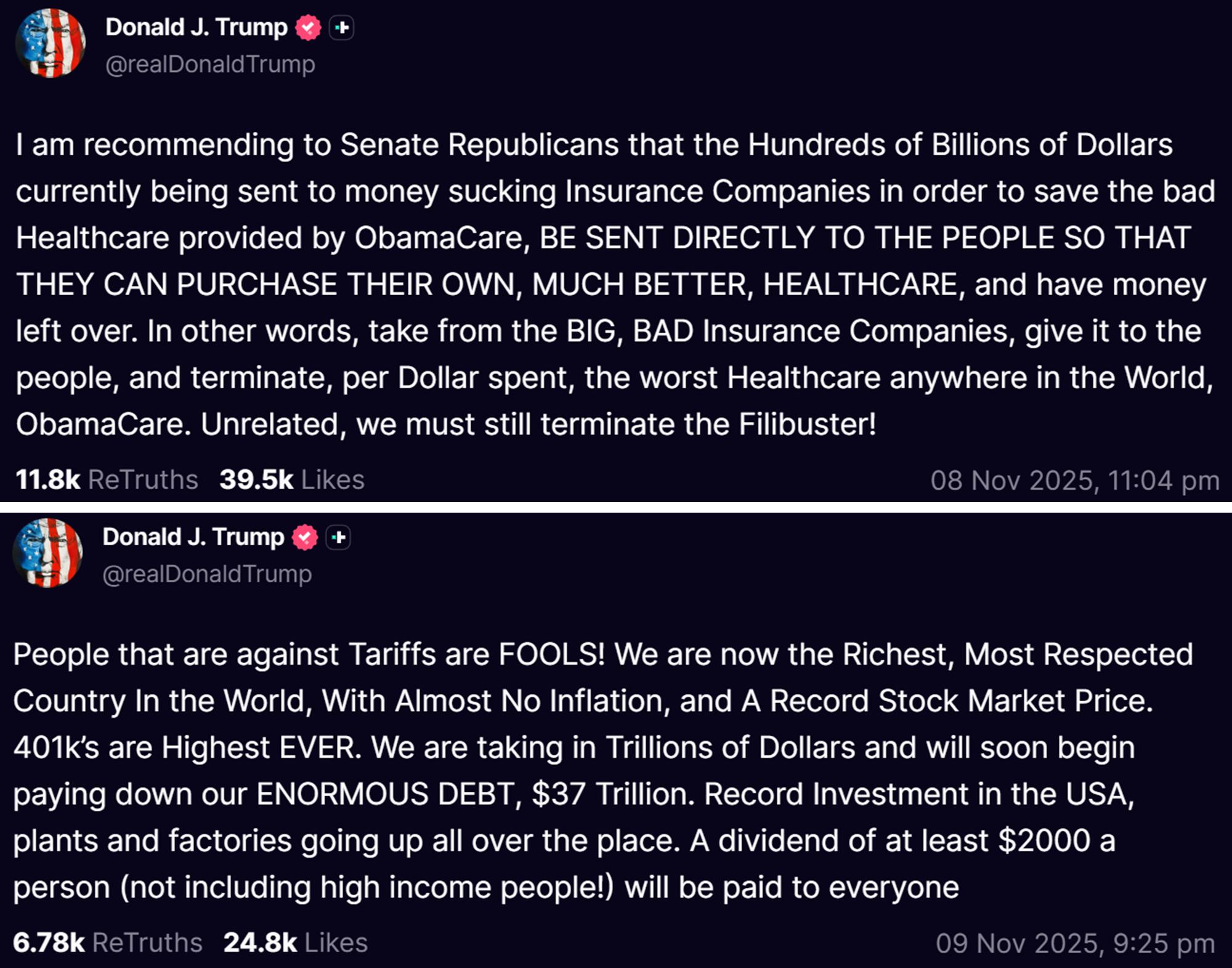

But not only does the end of the shutdown appear in sight, Trump is floating policy measures that effectively amount to stimulus - provide healthcare benefits, in cash, and a $2000 tariff dividend ('helicopter money') to Americans which has Bessent has said could come in the form of tax cuts. Even a watered-down form of these measures would be bullish enough to upstage any number of lingering concerns for the near-term and quite possibly till year-end - Buy Everything!

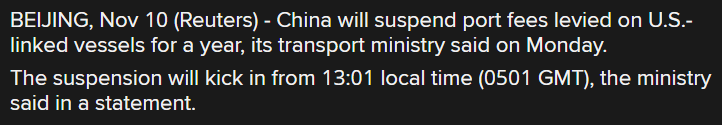

And trade tensions with China continue to unravel...

Before diving into the usual, I think it's worth evaluating prior views to see what themes remain relevant, and what risks we should be attentive to that will be helpful in guiding our strategy choices amid what looks to be very bullish setup for stocks into year-end:

- Week 41 Eye on Real Rates (Bearish)

transitioning into a Tightening rates regime - Week 42 Volmageddon-esque (Bearish)

risks of volatility becoming more elevated - Week 43 Flippage (Bullish)

anticipating a simmering down of trade tensions - Week 44 Relative Exceptionalism (Bullish)

continued rally into Trump-Xi meeting - Week 45 Tailwinds Are Now Headwinds (Bearish)

bull narratives exhausted - Week 46 Buy Everything (Bullish)

shutdown to end + stimulus?

![Week52 MacroTechnicals - Santa Claus is coming to [low-vol] town](/content/images/size/w600/2025/12/ARTICLE-Macrotechnicals-FINAL-01-2.png)