Week48 MacroTechnicals - Basing for a year-end rally

US data stays resilient; December FOMC is finely balanced with members expressing more caution. Rough week for Equities but may stabilise if volatility eases from here. Safe-haven flows supported Treasuries and USD causing distortions in rate differentials requiring careful evaluation.

US data show a still-resilient economy. The December FOMC meeting looks finely balanced, with a split between those pushing for another cut and others expressing a greater deal of caution. Globally, the US and Australia remain relative bright spots while the UK, Eurozone and parts of Asia show softer but mixed momentum. Markets have had a rough week, led by China tech and US mega-caps, but breadth and sector signals and positioning hint at stabilisation if realised volatility can subside from here. In FX and rates, safe-haven demand has supported Treasuries and also the dollar - thus making the divergence in rate differentials and the USD to be taken with a pinch of salt, and we highlight upcoming event-driven opportunities, particularly in AUDNZD and EURGBP which will be explored in more detail, as well as other views and ideas in the Technicals section.

Macro

US Labour Market

Finally... some hard data! Though it appears we won't be getting any inflation reports till after the next December FOMC meeting.

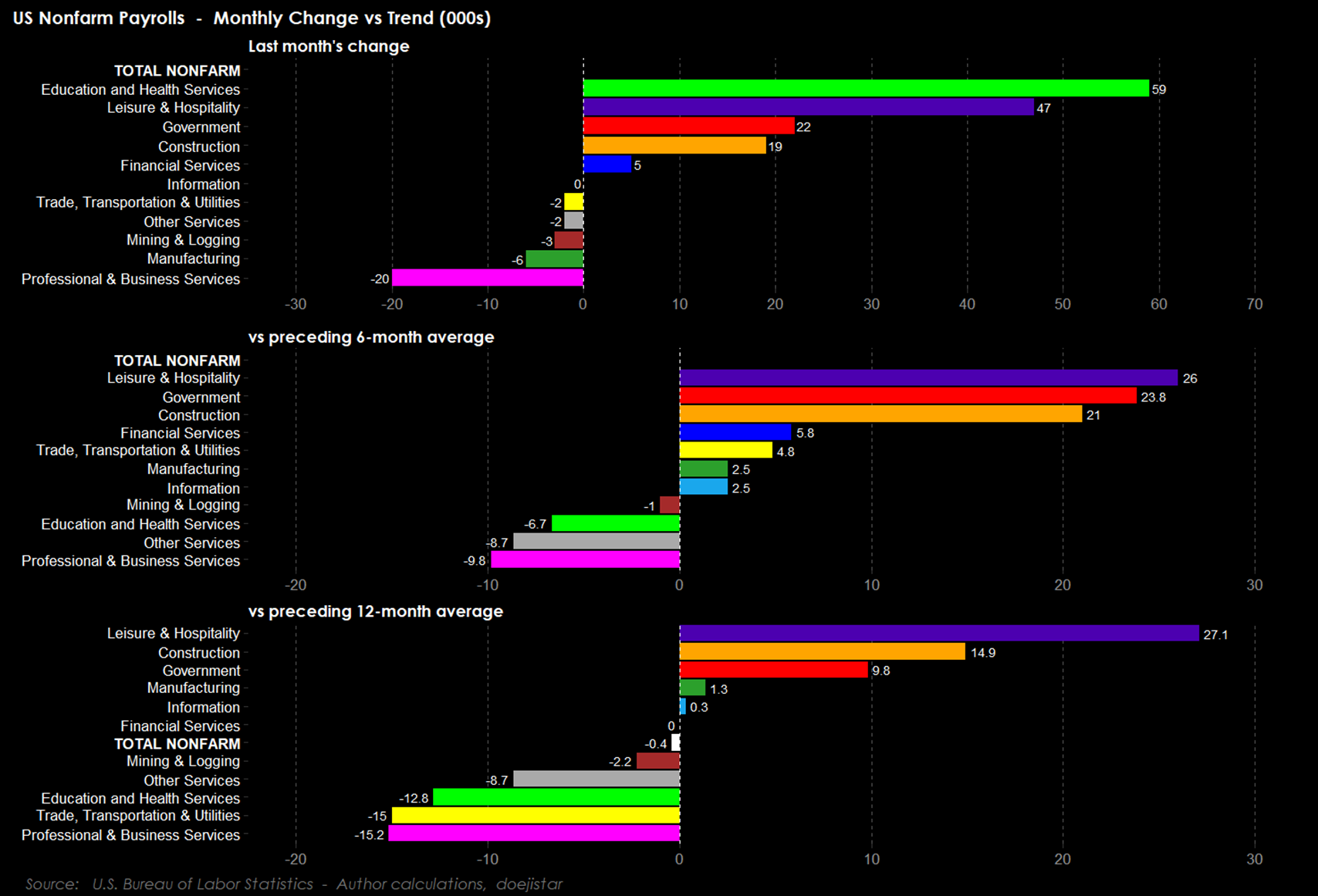

The September jobs report was a strong one coming in at +119k versus expectations being in the low 50k's, but that also came with downward revisions to August and July totaling -31k.

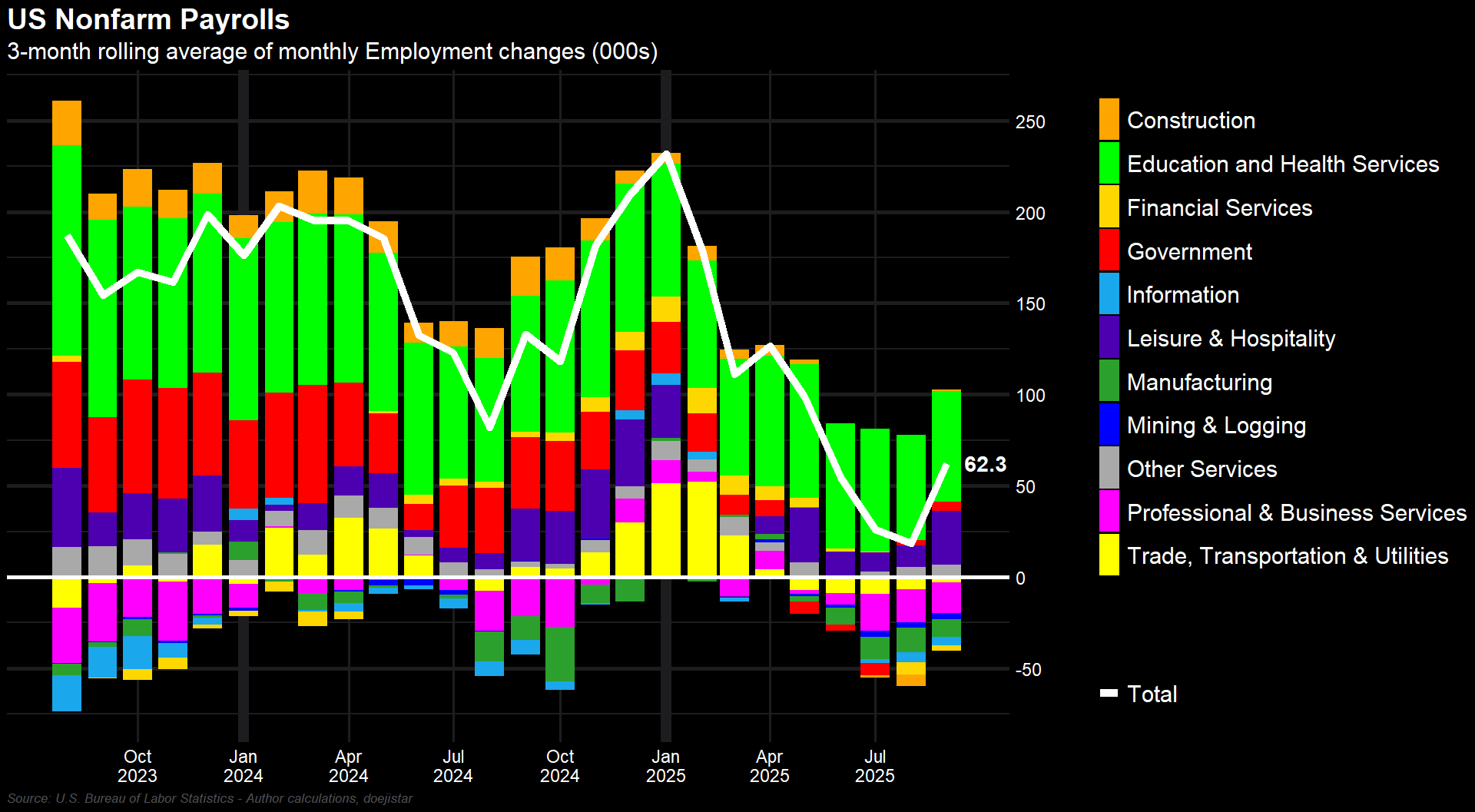

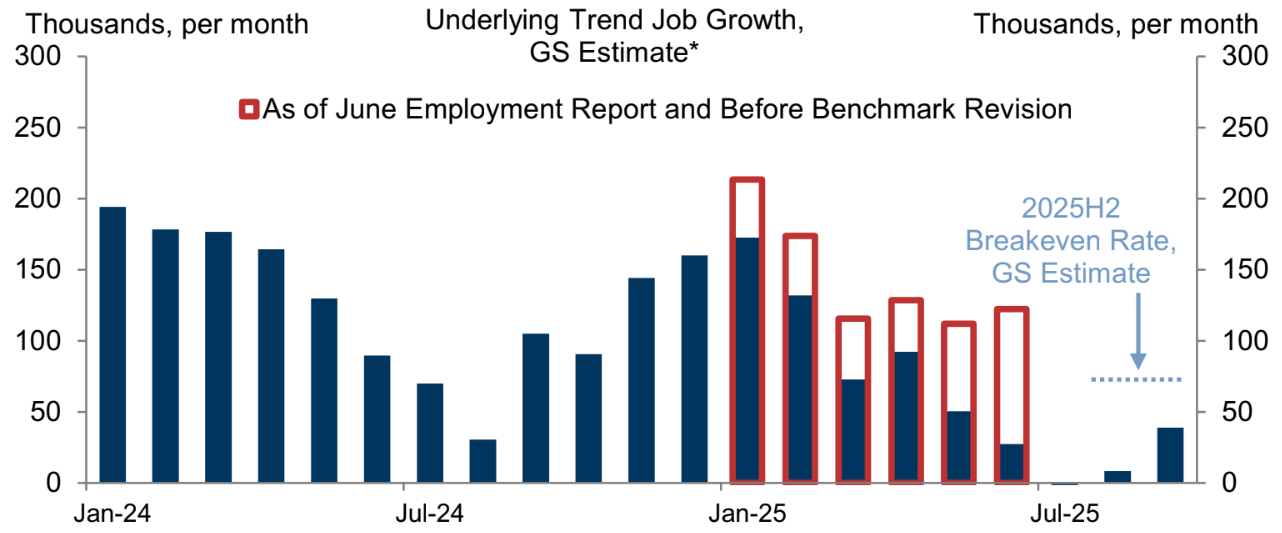

Accounting for those revisions, that takes the 3-month rolling average of job gains to +62.3k. This is at odds with the Private ADP Nonfarm 3-month average up to September being at +25k, and interesting to note that up to October, that figure drops significantly +3.3k.

Goldman's own estimate of the 3-month pace stands at 39k up to the month of September.

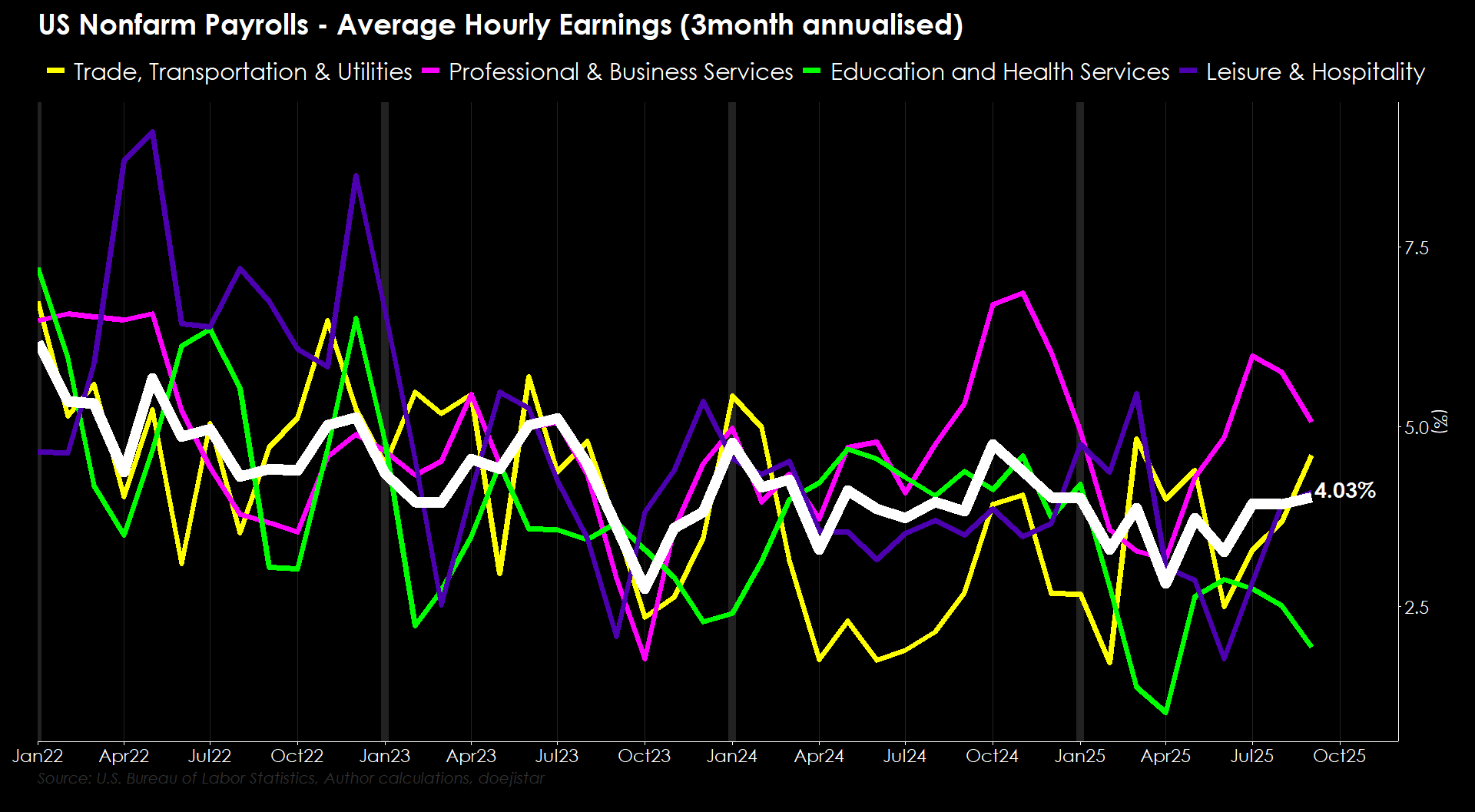

Wage growth remains quite firm running at a 3-month annualised rate of 4%, which is at the fastest pace this year, and since November of last year.

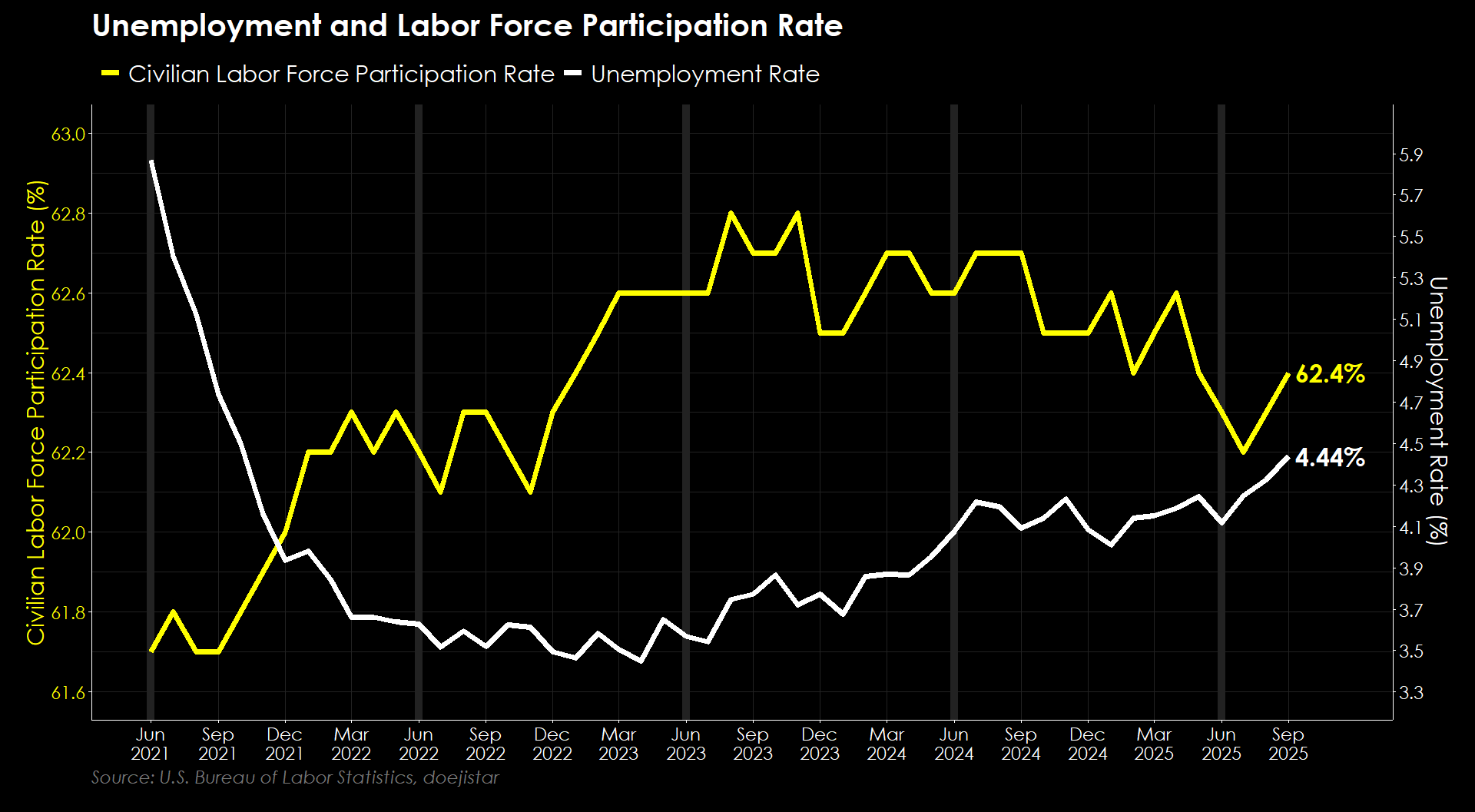

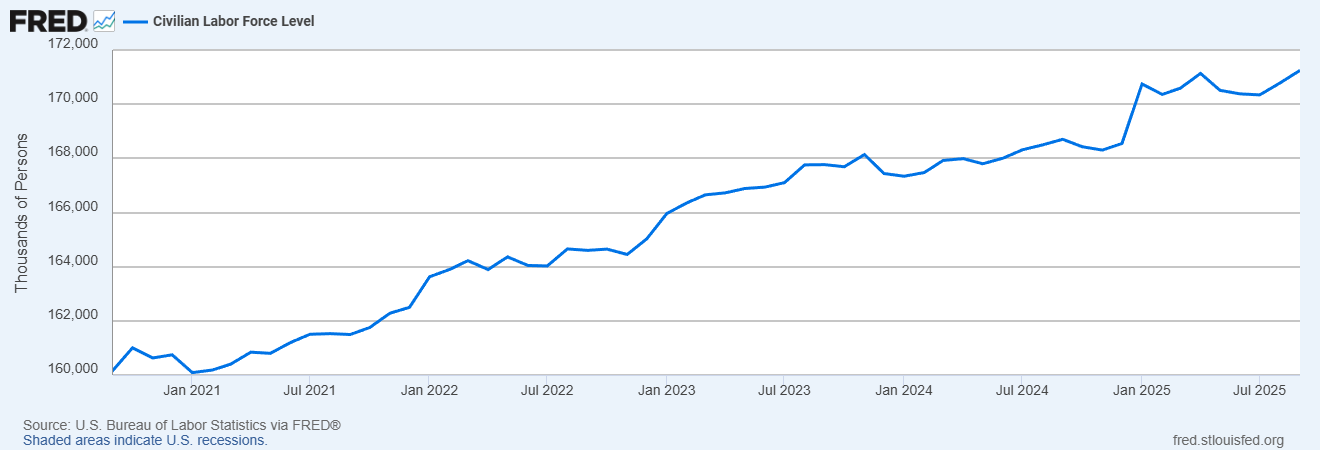

Unemployment rate reached the highest level in 4 years to 4.44% unrounded which will raise some brows. On the other hand, that latest rise was also accompanied by a rebound in the participation rate - suggesting that the rise in unemployment was driven by more workers entering the workforce rather than decreasing working population (chart - record highest labour force level), and thus rather than job losses.

It will be interesting to see how the October report looks after the Challenger report which, garnered a lot of attention among commentators and macro strategists, showed a huge spike in layoffs that month. In any case, that 4.44% unemployment rate needs to be taken with a large pinch of salt for the time being.

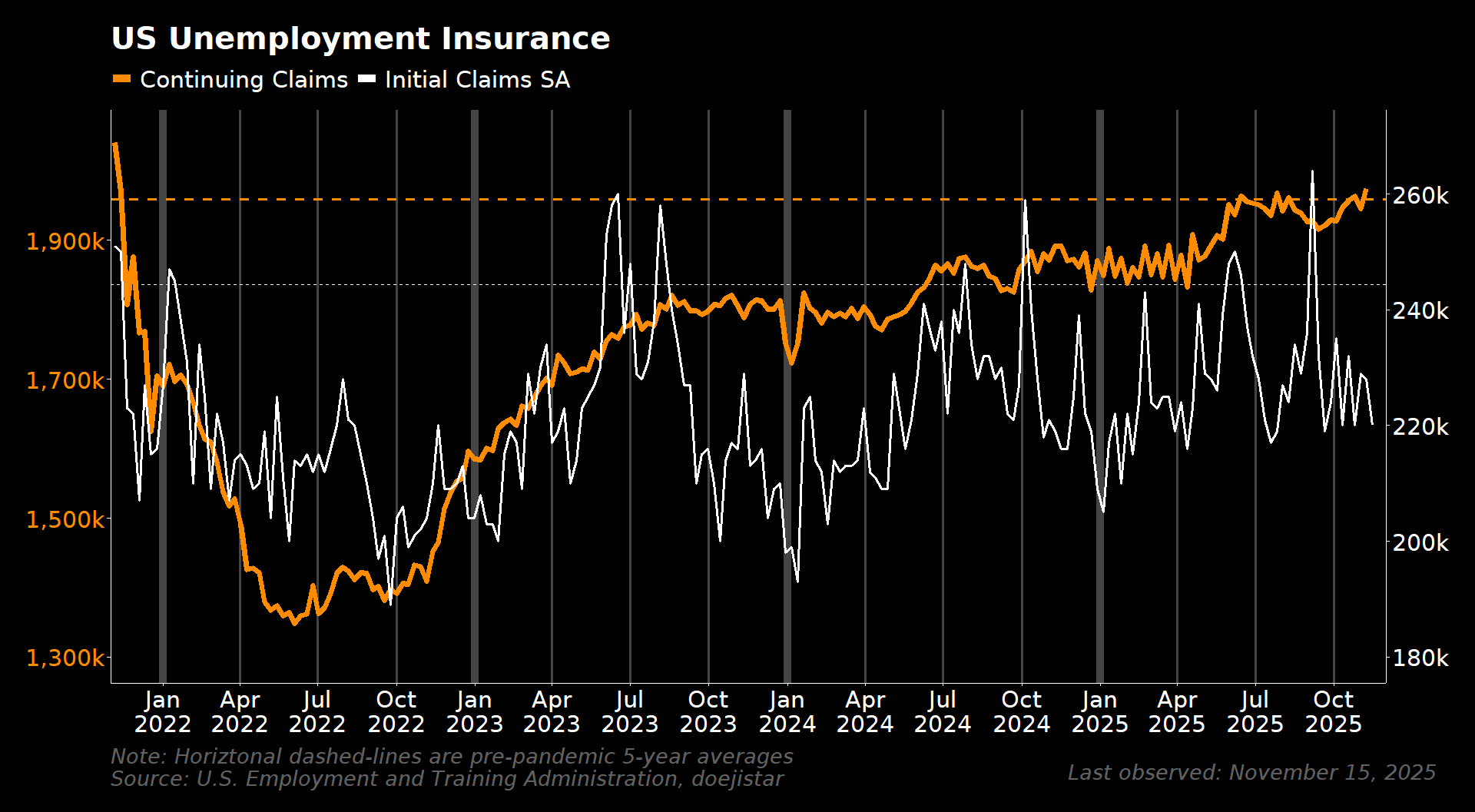

Initial unemployment claims was to 220k for the week of November 15th, 10k less than the 230k expected. Continuing claims rose to a new cycle high.

Fedspeak

We now enter the blackout period and given what we know so far, a December cut looks a very close call. Apart from the few that continue to express strong support for another 25bp cut, the rest of the committee has tilted towards a more cautious leaning. [Permanent voter (P), Outgoing (O), and Incoming (N) voter for next year]

Support for December rate cut

- Waller (V): available data strongly supports a demand-driven slowdown; underlying inflation is "relatively close" to the 2% target when tariff effects are excluded; medium- and longer-term inflation expectations remain well-anchored; supports December cut as "a matter of risk management".

- Miran (V): 50 bps rate cut is appropriate for December, while 25 bps is the minimum; back a 25 bp move in December if it breaks a tie.

- Paulson (N): no new recent comments but has previously expressed supporting a continuation 25 cut in December.

On-the-fence

- Cook (P): December remains a "live meeting" attentive to incoming data and risks.

- Barkin (N): pressure on both sides of the Fed's dual mandate; "weaker labor market than these numbers suggest"; "You may notice nothing I just said gives any guidance for our next meeting. That's intentional, as I think we have a lot to learn between now and then."

Cautious on further rate cuts

- Jefferson (P): rates now closer to neutral; concerned about relying on the assumption that tariff-driven inflation increases prove temporary; evolving balance of risks-of stubborn inflation and weaker employment conditions-underscores the need to lower interest rates slowly.

- Barr (P): "We need to be careful and cautious now about monetary policy"; importance of conducting policy "independently of short-term political pressures".

- Collins (O): "the current policy is in a somewhat restrictive range following the 50 basis point reduction we made in September and October, and that seems fitting" given present economic conditions; "I do see reasons to be cautious" for December; previous mentioned "relatively high bar" for additional easing in the near term and that policy rate will likely need to stay on hold "for some time".

- Musalem (O): no new recent comments but previously expressed caution - "limited room for further reductions without monetary policy becoming overly accommodative”; “not our job to opine on particular valuations of markets, but if you look at that report, house prices seem elevated relative to historical standards, stock prices seem elevated, and to me it’s just the flip side of accommodative financial conditions”.

- Kashkari (N): no new recent comments but previously expressed caution - "We have inflation that's still too high, running at about 3%".

Opposed to further cuts

- Logan (n): October cut was "not justified" given persistently high inflation and a labor market that is "roughly balanced"; "I'd find it difficult to cut rates again in December unless there is clear evidence that inflation will fall faster than expected or that the labor market will cool more rapidly"; "the Fed needs to offset financial condition tailwinds"; monetary policy is "likely not very restrictive";

- Hammack (n): opposed October cut; monetary policy is "only marginally positioned to exert restraint on price increases"; warned further rate cuts risk promoting "excessive risk-taking in financial markets" and could extend "the current phase of high inflation"; financial conditions are currently "quite accommodating" with rising stock prices and "easy" credit availability - making credit even more affordable "could encourage risky lending practices".

- Goolsbee (o): uneasy about recent rate cuts; "my discomfort stems from the rapid implementation of too many rate cuts in the short term and relying on the inflation increase we've observed to be temporary"; "If I find myself strongly aligned in one direction that contrasts with the prevailing views, then so be it, I believe dissent is not inherently negative".

- Schmid (O): no new recent comments but previously expressed caution as well as dissented against a cut in October - “I do not think further cuts in interest rates will do much to patch over any cracks in the labor market — stresses that more likely than not arise from structural changes in technology and immigration policy. However, cuts could have longer-lasting effects on inflation as our commitment to our 2% objective increasingly comes into question."

Flash PMIs

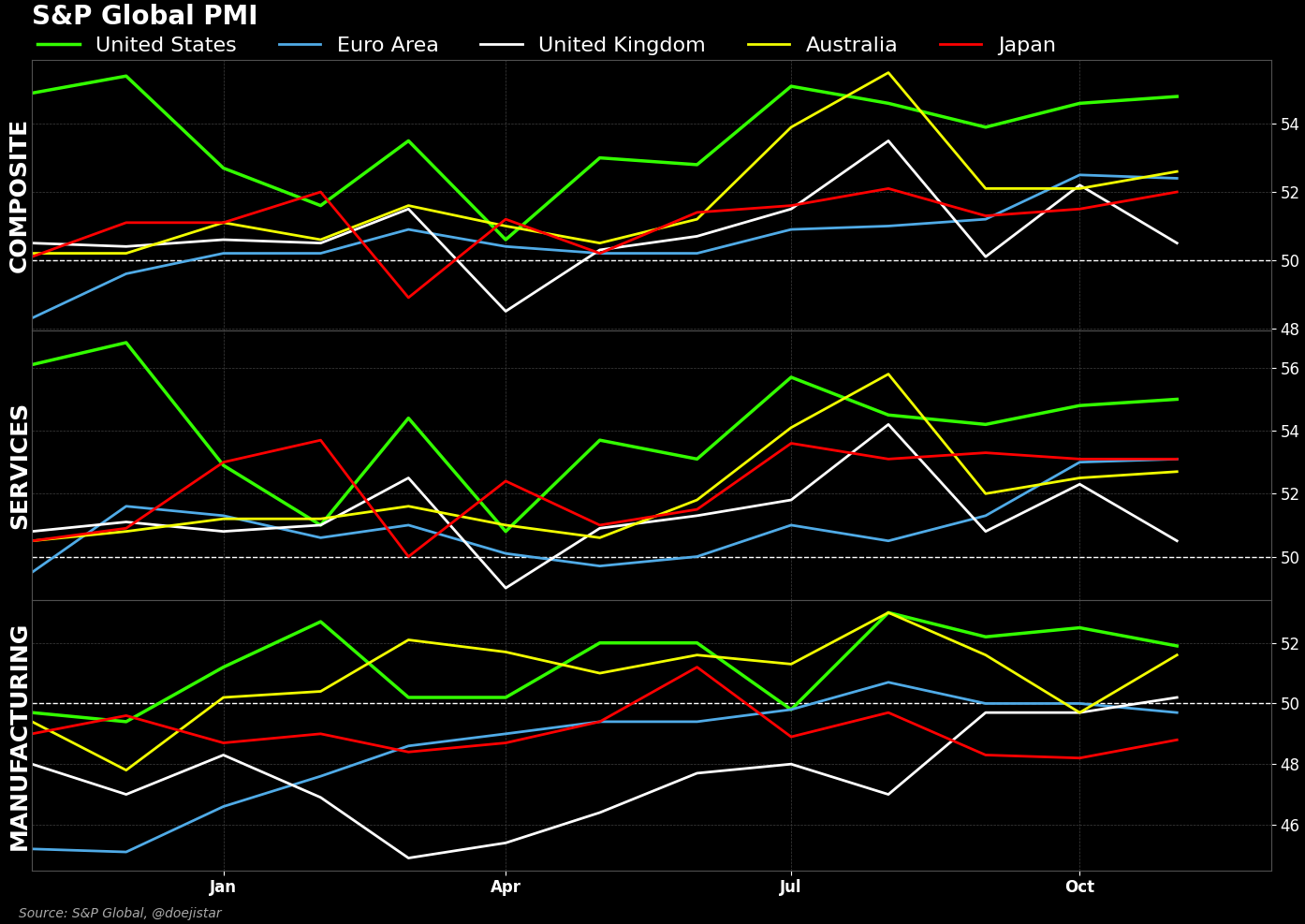

US PMIs continues to be the standout followed by Australia reporting a broad growth acceleration. Common themes in the reports are large centred around accelerating increase in input costs with output prices easing appears, indicating the increasing challenge of passing on costs to customers.

US

US activity growth accelerated for a second consecutive month while confidence improved markedly. The pace of job creation meanwhile remained only modest, due principally to cost concerns. Input costs rose at one of the fastest rates seen over the past three years, driving a reacceleration of selling price inflation. Higher costs and prices were again commonly attributed to tariffs.

UK

UK Service activity slowed to 50.5 from 52.3 the prior month, a 7-month low. Output price inflation rose as the slowest rate in nearly 5 years, even as input prices accelerated. Businesses also reduced their headcounts more aggressively that in October which much of the malaise being blamed on the uncertainty around the new budget.

Eurozone

Services sector growth in November but new order growth is seeing a slowdown while business confidence has weakened as price pressures intensified with input costs rising at the fastest pace since March while output prices eased. On the flip side, manufacturing continues to be very weak particularly among the major economies though business optimism is steadily improving.

Australia

The composite index ticked higher to 52.6 from 52.1 in the prior month, service ticked up to 52.7 from 52.5, and manufacturing bounced back into expansion at 52.1 after dipping into contraction last month. New orders accelerated in November due to faster service sector growth and the first rise in manufacturing goods new orders in three months, and employment rose albeit at a slower pace.

Japan

Marginal improvement in the composite index to 52.0 from 51.5 the prior month which was due to an improvement in business confidence in the manufacturing sector. Staffing levels rose at the quickest pace since June while input prices rose at the sharpest pace in 6-months.

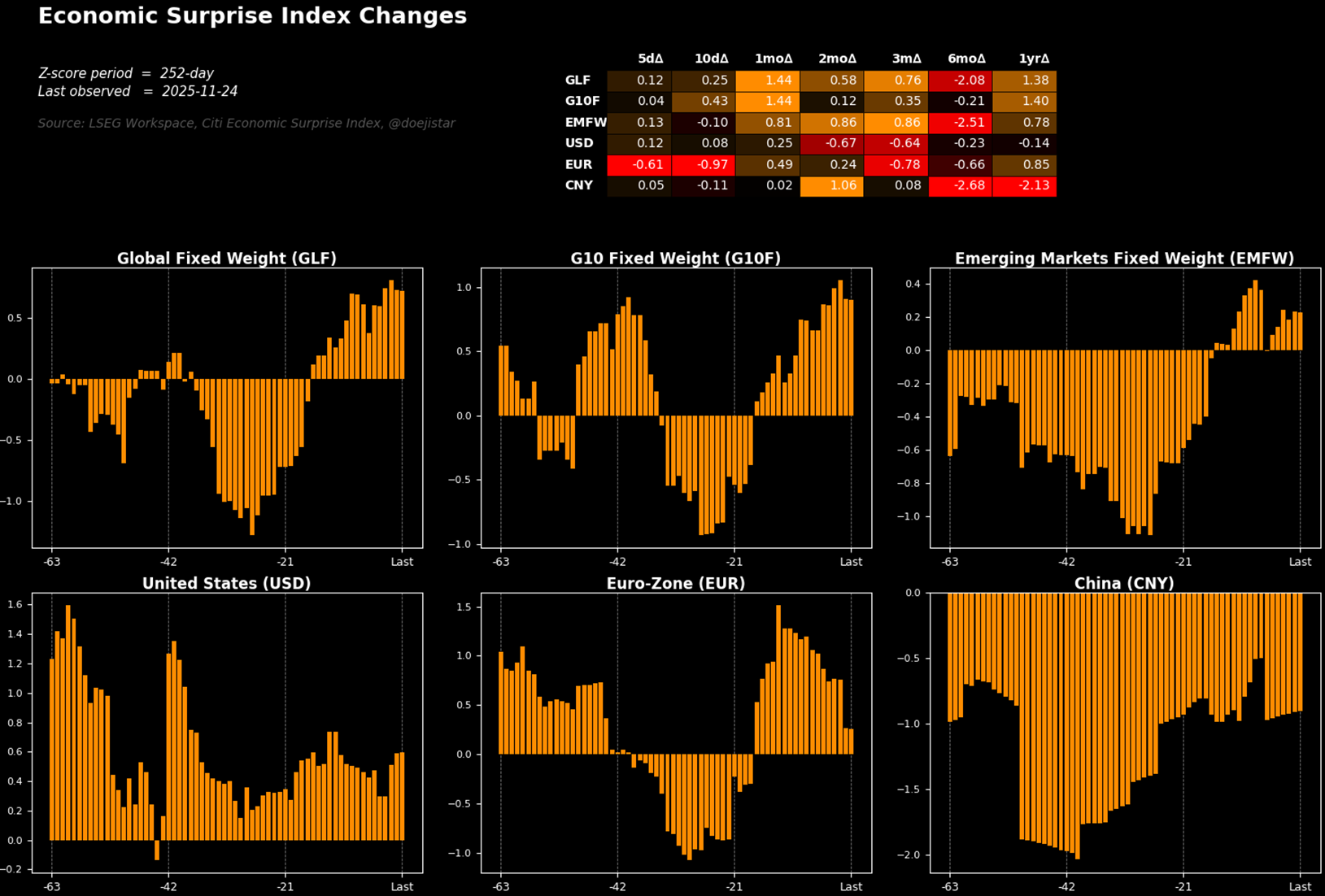

Economic Data Surprise Trends

Data trends have continued to turn more positive on the whole, US showing resilience, Europe lost the positive momentum seen a month ago, and China has been in a stall over the past month.

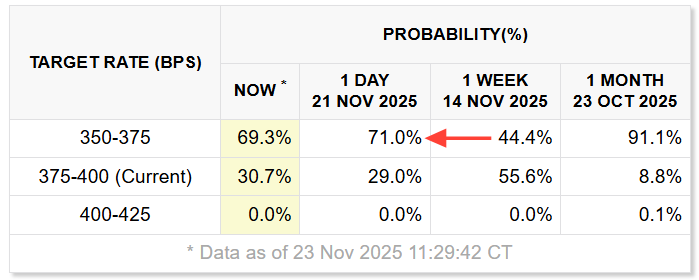

Views

December odds have shifted towards a 25bp cut the past week to roughly 70%, after being more of a doubt the 2 weeks ago. I think it's very 50/50 based on recent comments and in my view, a cautionary-hold (over a cautionary-cut) would be appropriate given the uptick in inflation which is not yet proven to be 'transitory due to tariffs', wage growth running at a 3-month annualised pace of 4%, labour market showing signs of life in September after consecutive monthly declines, overall data trend for the US appears solid, and real GDP for Q3 clocked at 4.2% according to the latest Atlanta Fed estimate suggesting the economy is still in a good place even if we were to loosely discount the impacts of lower imports and AI.

Overall, no genuine reason to be concerned about the US economy, and thus a deeper sell-off in US stocks after some froth in the AI theme has come off.

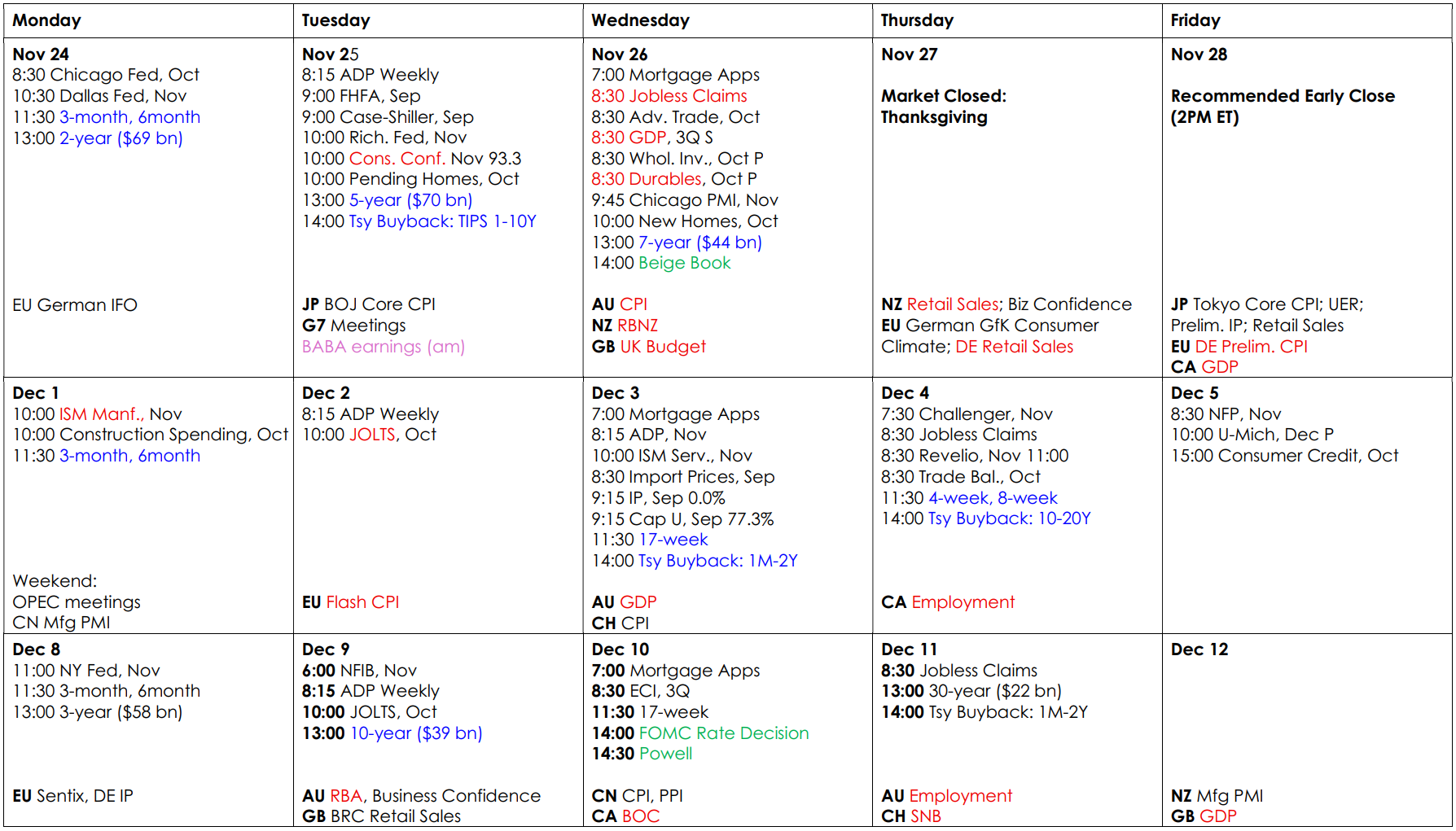

Looking ahead

Relatively quiet calendar on the US side but a few big events and data releases elsewhere - particularly on Wednesday with the RBNZ rate decision, the UK budget, and Australian CPI to name a few.

![Week52 MacroTechnicals - Santa Claus is coming to [low-vol] town](/content/images/size/w600/2025/12/ARTICLE-Macrotechnicals-FINAL-01-2.png)